#IMadeThis – Innovators, entrepreneurs, and idealists

Ever wondered how successful entrepreneurs turn their dreams into reality? What drives them to push the envelope, create change and advance their industries? We had the opportunity to ask Canadian small business owners how they transformed their ideas, goals and passions into reality.

Horizn is a software company that works with global industry leaders to deliver transformational change. Focused primarily on helping financial institutions accelerate digital and mobile adoption for their staff and clients, Horizn has launched products in more than 50 counties and 15 languages, and boasts a client roster that includes heavyweights such as RBC Royal Bank, U.S Bank, M&T Bank, Nationwide Building Society (UK) and Key Bank.

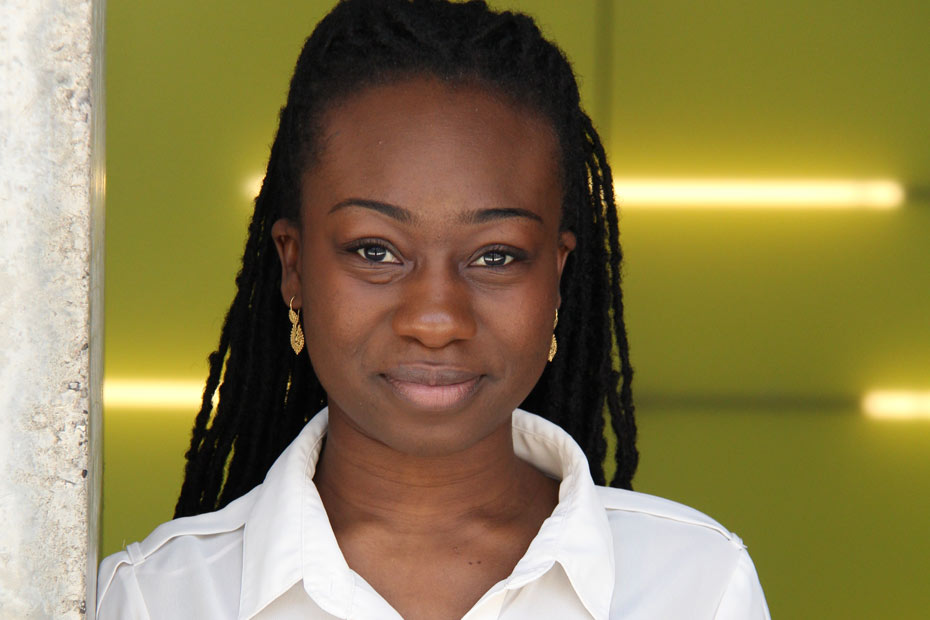

Recently Horizn Founder Janice Diner sat down to discuss how she got her start, her approach to funding, and some of the challenges she and Horizn have faced along their path.

Q: How did Horizn begin its journey, and what problem does it solve for your clients?

Diner: Horizn got its start because I saw an opportunity, and turned it into a business. I saw companies investing hugely into new product innovations that were not being optimally adopted by their customers. Innovation is nothing without adoption, and many companies weren’t thinking about how the technology would be used and received by their customers.

Our mission is clear: every time your financial institution launches a new innovation, product or feature, the second it goes to market Horizn ensures that everyone is digitally fluent.

Q: You have said that Horizn is “bootstrapped, profitable and proud.” Can you elaborate on that?

Diner: Many people tend to think that the only way to start a business is to raise money. At Horizn, we bootstrapped the business to get started, which means no third party equity has been raised in the business. That’s not to say that there’s anything wrong with raising venture capital funding — but the important message is that there are many ways to build a business.

And it is common knowledge that women are drastically under-represented at the finance table raising capital, under-represented in the C-Suite, and as board directors. Because it’s very difficult for women to raise money, we chose to bootstrap and be client-funded. But, it’s important for women to know that there are other ways to build a business.

Q: How do you determine which funding approach is right for a given business?

Diner: I look at money as fuel — it’s all equal to me. At the end of the day, money is capital to build and run my business. That’s true no matter where that money comes from. I’m not here to tell you that you should — or should not — raise money. Some businesses just can’t start without venture capital funding.

At Horizn, we were fortunate to be able to build a product in real time with customers, so we had a product, a client and a source of revenue from day one. Not everyone is able to do that and be profitable right out the gate.

Q: What are some of the main benefits to bootstrapping?

Diner: When you bootstrap, you must get paid for everything you produce. As a result, it’s critical to build a product that works — one that your clients love and that their users love, and that you’re meeting the ROI of your client’s business.

I also believe that when you bootstrap, you’re earning the right to hire, versus raising the right to hire. There is a subtle difference, but when you bootstrap, you only develop product that is purchased by clients. Because they pay for it, you can pay your staff. When you raise, you have the capital to hire regardless of what is happening with the product and the client who is paying for it.

Q: What are some of the challenges you have faced while building your business?

Diner: We have had a few groundbreaking moments. The biggest one was in 2012, when we landed a multi-year, multi-national contract from Motorola Google … and we had four staff in the office. It was a real challenge to be a global company and meet a global contract. It took us a few years to be as global as the contract we had.

Q: What do you attribute to your business success?

Diner: Vision, grit, people. And relationships matter.

Once you get a customer, love your customer. Understand how they run their business, understand what they see as success. One of our most important tenets is, “Get on a plane.” In other words, meet your clients, get exposure for your business, and maintain consistent contact.

Also, I believe that culture eats strategy for breakfast every time. Hiring the best people is critical.

Q: You have an interesting take on “mistakes” in business. Can you tell us about that?

Diner: You can’t worry about the mistakes, because you’re going to make a lot of them. You always have to be doing things differently, reiterating and making things stronger and better. If someone slips on something, for us it’s natural to turn that “mistake” into an opportunity.

Q: Finally, what advice would you give to entrepreneurs just starting out?

Diner: There are five pieces of advice I would give to new entrepreneurs:

1.Build product in real time with your customers

2.Love you customers and make them love you.

3.Visit your clients and go to industry events.

4.Hire the best — people are everything when you are building a great product.

5.Remember you are not in the start-up business. You are in a business.

In November 2018, 23 women were recognized at the 2018 RBC Canadian Women Entrepreneur Awards. These exceptional women, and their trail-blazing companies from a variety of industries, share a common goal — to be the best at what they do.

More from the Canadian Women Entrepreneurs Series:

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.