From drastic changes in routine to a brighter spotlight on health and wellness, a decline in social events to financial insecurity, the effects of the pandemic have been personal and diverse. While no two paths have been the same, many Canadians have transformed their lives as what truly matters to them became clearer.

RBC recently connected with Canadians who accepted the challenges the pandemic thrust at them and turned them into fresh starts, new ideas and expedited goals. Here are three stories of Canadians who found their own silver linings.

Kevin: Repurposing time, reprioritizing life

Kevin was in Canada less than four years before the pandemic struck. He worked long hours, travelled a lot, and felt plenty of pressure to perform at work. He had an eye on a house in an exclusive Toronto suburb with a pool, horse and maybe a nice car.

When the pandemic struck, Kevin decided to change jobs, moving from a big organization to a smaller charity where he could make a bigger impact. And with travel no longer a part of his world, he found himself with more time on his hands. “When there’s no travelling and no more being tired on Friday nights after a long week on the road, what do you do?” he asks. “Do you just sit down and get a suntan? Or do you actually embrace your new life and change the chip?”

With an extra 6-7 hours per week now available to him, Kevin decided to start a side gig. He launched a software consulting business and today, he has 12 partners. Together they have a goal to help 1 million people have access to technology to help enhance their rehabilitation.

Beyond how he’s working, what Kevin is working toward also shifted. “My goal has changed from ‘a big house with ten cars and ten swimming pools,’ to a tiny, little one-bedroom place on the south coast of Spain. That’s what I want and what I’m working toward.”

When he couldn’t help his mother who lives alone in Ireland, the pandemic made Kevin think about his purpose in the world. “It’s shone a light on what I can do,” he explains. “I’ve been challenging myself, asking, ‘how much good are you doing on a daily basis? How are you giving back? How are you helping people?'” Kevin started proactively reaching out to local charities to volunteer and make a difference from the ground up.

Kevin found opportunity, purpose and new priorities during the pandemic. By finding work that matters to him, doing good for others and making time for what he loves most in life, he feels he’s on a path of fulfillment and happiness.

Erico and Lucy: A fast track to their dreams

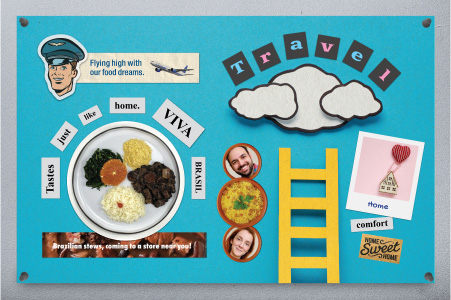

Erico and Lucy are newcomers to Canada, having moved here from Brazil in 2017. Pre-pandemic, Erico was an airline pilot and Lucy a pastry chef. Their goal was to keep working these jobs for the foreseeable future and open a business at some point down the road.

When the pandemic hit, Erico was laid off and the couple chose to move ahead with the dream of starting a business. “After I got laid off I spent a few months at home planning for our business and we opened it by the end of November.” Today, their Brazilian foods company Farofa Foods sells in 12 stores across British Columbia and online. They’re talking about expanding across Canada but want to grow carefully and thoughtfully.

Erico and Lucy’s lives transformed in more ways than one. During the pandemic, the pair started exercising more. Erico has lost 50 pounds and Lucy has shed about half of that they say. It’s a routine that will continue well into the future. “I’m never stopping,” Lucy says. “The pandemic put our health situation front and centre — and I think we all realized how important is.”

Erico and Lucy underwent full transformations — they became entrepreneurs, focused on their health and got fit.

Linh: Turning pandemic savings into an early retirement plan

Linh is a single mother living in Alberta supporting her mother and her sister’s family. Her daughter is a competitive volleyball player, and in 2020 her niece graduated from high school. They had planned a family trip to the Bahamas to celebrate graduation — but the trip, the ceremony, the banquet and all festivities were cancelled.

But the pandemic brought about some positives for Linh and her family too. “I just love working from home,” she says. “Before, I had to shut down my work computer and run for the bus. And if I missed the bus it would take me another hour to get home and then prepare dinner. Now, I can shut down my computer and go make dinner.”

An accountant by day, Linh began juggling finances to adapt to her work-from-home routine and found great ways to save. She and her mom found they could share a car, so Linh cancelled the insurance on the other. Her clothing, bus pass and gas costs decreased considerably. And, Linh got creative with her cooking — she found and developed copycat recipes for her family’s favourite takeout meals. She now has three binders full of low-cost recipes that have the family’s stamp of approval.

Even her gestures of goodwill have paid off — Linh shops for three other families, and now when she goes to Costco, she’s not distracted by the things she doesn’t need. She has three lists, sticks to what’s on them and doesn’t browse into aisles that might tempt her.

The thought of returning to the office every day, combined with the money she saved during the pandemic, has enabled Linh to consider moving up her retirement date. “This work from home has really changed me,” she explains. “I just don’t want to have to commute to work anymore, so I’m thinking if I’m able to save a bit more, I can retire earlier.”

Linh discovered the freedom and flexibility of working from home and the financial benefits that come with staying in. While she’d love to get back out and travel (Vegas might be the first stop on her list), the pandemic has allowed her to find new says to save and reallocate her savings to what really matters — an early retirement that will give her more time for her family, and for herself.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.