Q: 2020 was a tough year by all measures. How did the Roytrin Fundsfare during the past year?

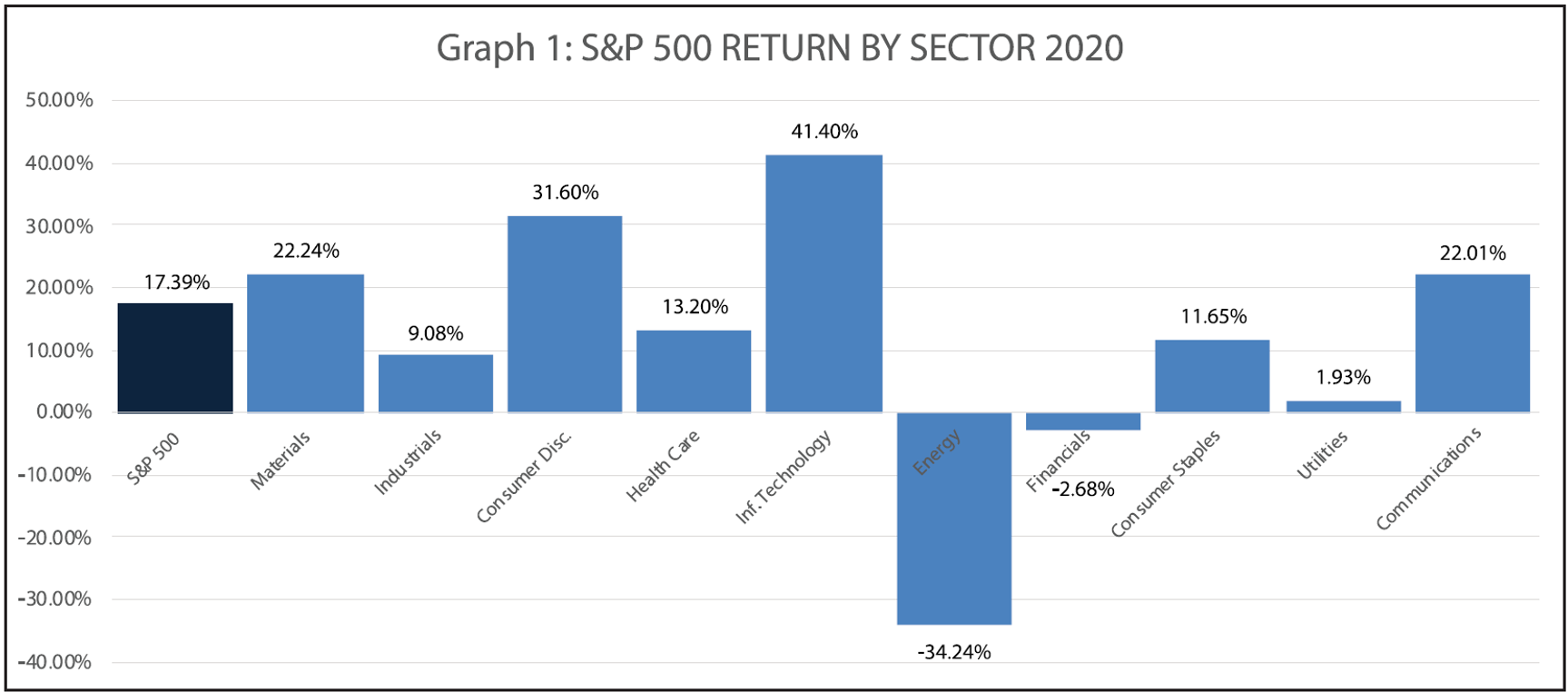

It has indeed been a challenging year. In particular for Q2, from a market perspective, we saw declines in all financial assets. The economic impact of the pandemic is still far from over and will last well beyond the global vaccination campaign currently underway. That said, we have seen markets recover very quickly largely due to (1) unprecedented stimulus, both fiscal and monetary, (2) very low-interest rates and inflation, (3)a build-up of surplus liquidity globally, and (4) vaccine development. Markets rebounded over Q3 and Q4 and ended the year at new highs with fears of excessive optimism in certain sectors, particularly Technology, which saw by far the steepest increase (Graph 1).

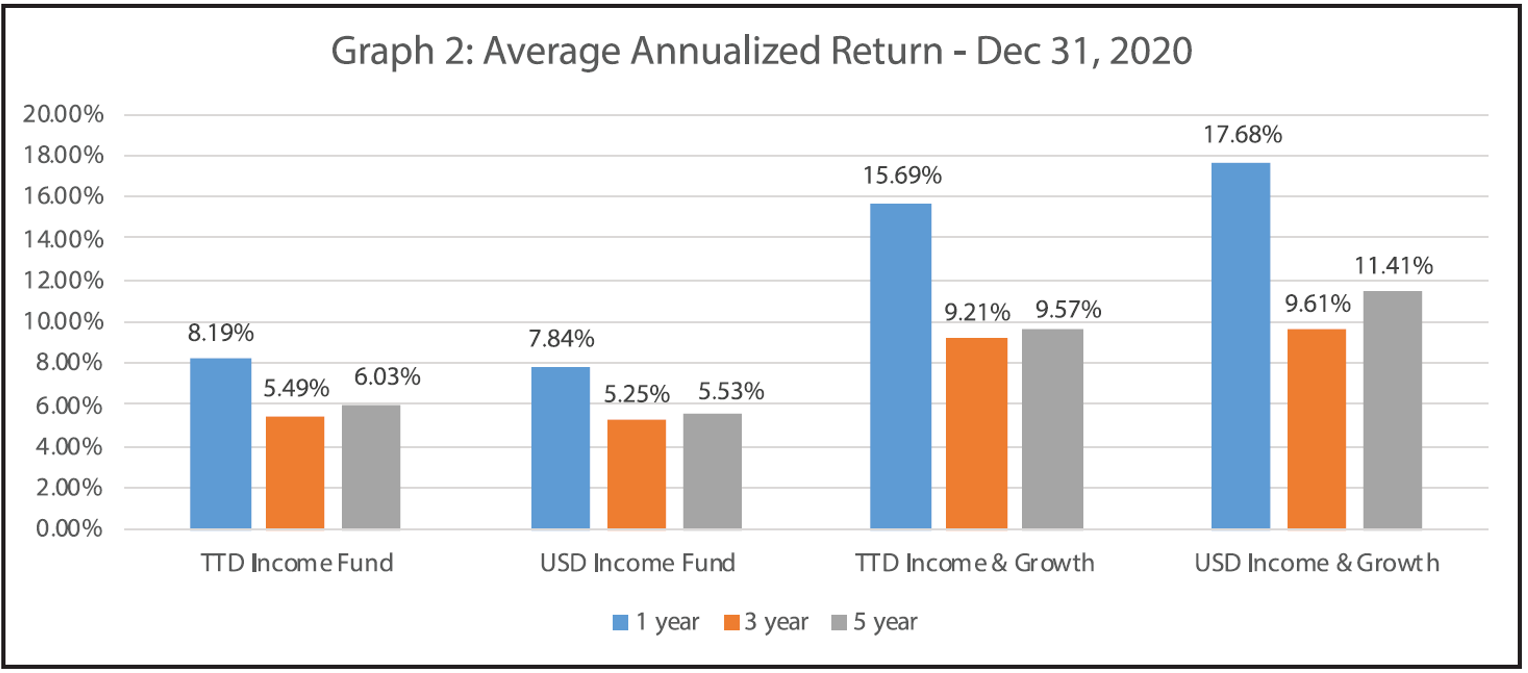

As investors sought safety, U.S. Treasury rates declined significantly over the year while spreads on credit more than tripled during Q2 as investors left risky assets. Overall, however, credit spreads ended the year roughly back where they started. U.S. treasuries recovered from their lows but still remained about 1% lower than where they started the year. This combination of a lower U.S. treasury rate and unchanged spread caused fixed-income assets to appreciate over the year. For the theRoytrin Funds, we capitalized on the Q2 turmoil and this strategy paid off (Graph 2). The trough to peak recovery in the S&P 500 during 2020 was a whopping 63% and so to the extent that we bought on this pullback, the return of the Funds was enhanced relative to the overall market.

Q: What is your outlook for 2021?

For 2021, we anticipate markets will sway between hopes for an eventual recovery from the pandemic and the sobering short-term reality of the current environment. On the positive side, there are several approved vaccines for COVID-19 and distribution has started with over 200 million doses administered thus far. Positive growth in China – 6.5% y-o-y in Q4and 2.3% for FY 2020 – has provided some comfort that the world’s second-largest economy has managed through the pandemic and has quickly bounced back economically. In the U.S., the election and inauguration of a new president have also been viewed as a positive development and it is expected to bring more political stability to the world’s largest economy.

Recent economic data in the west – in particular in the U.S., Britain, and Europe – has been mixed, as winter has brought on a resurgence inCOVID-19 cases forcing many jurisdictions back into lockdown measures. The U.S. experienced net job losses in December after several months of positive numbers and only managed 49,000 net positive jobs in January 2021. Retail sales have also shown month-over-month slowdowns over the last 2 months of 2020 but surged in January 2021 to 5.3% as consumers made good use of their stimulus cheques received from the December 2020US$900 Billion stimulus plan.

For the remainder of 2021, we expect data in the U.S. and Europe will continue to face pressure from an uneven vaccine distribution schedule, combined with the potential pitfalls of new or more challenging strains of the coronavirus. Net job losses or a slow-down in job creation could continue for several months if newer strains force more lockdowns or stricter measures. President Biden’sUS$1.9 trillion stimulus plan is hoped to be passed before mid-March when some employment relief measures are set to expire and if it is, this will certainly help to keep the economy going while vaccine distribution takes place. These stimulus plans, while helpful in avoiding a more precipitous downside, they do not have a lot of forwarding momentum. To avoid a slowdown in the recovery, these economies need millions of good-paying jobs that will allow consumers to get back on their feet more quickly. A potential boon for the American economy could come in the form of a substantial infrastructure investment program currently in the works of the Biden Administration. However, while it may be on the table for discussion, the new president still needs to navigate through the legislative challenges that can arise when trying to pass such a significant spending package through Congress.

Overall, markets may continue to be cautious in 2021, but we anticipate optimism over a long-term recovery will remain. This optimism, coupled with low-interest rates and supportive governments and central banks, will likely give investors comfort.

Q: How are you positioning the Roytrin Mutual Funds?

For 2021 specifically, we have taken some profits on some overvalued positions and remain vigilant for opportunistic buying as we think there is the potential for companies to fall short of investor expectations. This does not mean that these companies are not great companies, it just means that, in the event of a slower-than-expected recovery, the likelihood for investor expectations to get ahead of reality is high and so when companies announce results, that may be very good results all considered – but to the extent that it falls short of expectations, the stock price could decline to result in a purchase opportunity.

Over the long-term we remain positive on equity as an asset class and our key investment themes remain the same as has been outlined before; i.e. (1) The commoditization of everything; (2) Demographic changes; (3) Increasing inequality; and (4) Climate change. What we are focused on now is trying to determine what impact the pandemic will have in these areas and which industries and specific companies will benefit and thrive. The commoditization of everything and increasing inequality are linked in that one begets the other and we continue to believe that this will be the dominant concern going forward. We are already seeing many companies place increasing importance on issues such as inclusion in their policies and practices. This is a start but there is much further to go. At the most fundamental level, there needs to be a demonstrated understanding that in order for a company to be successful, consumers also need to be successful – or else who will buy their products and services? Companies seeking to address this in meaningful ways, we believe, will be rewarded in the long-run.

Climate change, though overshadowed by the pandemic in 2020, will also regain its position as a critical issue. Many countries and companies remain committed to carbon-neutral targets by 2050. There are significant opportunities as new technologies and innovative approaches are developed in the areas of food production, energy generation, carbon emission management, waste management, recycling, and transportation. Our focus here is to determine which technologies and innovations are financially viable and will become more dominant and which will remain as just good ideas.

For interest rates, overall we continue to believe that they will remain low. Much like the last cycle, growth will be sluggish with little threat from inflation. As such we are holding on to longer durations in an attempt to earn higher yields. Short-term interest rates are very low – just about 10 bps and 60 bps respectively for 1 year paper in the U.S. and in T&T. This is unlikely to change anytime soon as surplus liquidity will remain the norm worldwide.

Q: What are your views on the local environment?

The T&T economy remains challenged: growth has been negative for3 of the last 5 years from 2015 to 2019 and cumulatively would have declined over that 5-year period. This was before the pandemic impact so it is expected that 2020 was yet another year of negative GDP growth and 2021 may be as well. Energy prices have recovered nicely from the lows seen in 2020 with WTI now over $60 per barrel and natural gas over$2.70 per MMBtu, however, production continues to decline, with natural gas down 27.4% y-o-y in Q4 2020 and crude oil production down 4.9%. Debt is growing and there remains a significant shortage of U.S. dollars to support our imports. The International Labour Organisation (ILO)reported that Latin America and the Caribbean has seen the greatest contraction in working hours in the world, with an estimated loss of around 20.9% for the first three quarters of 2020. This is almost double the global estimate of 11.7%. We believe this is the opportune time for governments and businesses to re-evaluate their business models. The old models that were heavily reliant on the supply of U.S. dollars from the energy industry will not work as well going forward. This may be the time to start developing new businesses focused on increasing self-reliance thereby reducing imports or projects that improve efficiencies and/or optimize our natural resources and also developing products and services that could be exported. We recently invested in a green technology fund that develops and operates solar farms throughout Central America and the Caribbean and we would certainly be happy to support similar projects in T&T. We think there is a lot that can be done in other areas such as agriculture, cocoa, cannabis, tourism, and recycling. Therefore it is more a question of getting the right knowledge and skills together with the required capital to get viable projects off the ground. Here we see the need for patient capital as these projects will need time to develop and we are willing to be providers of this type of capital for the right projects.

Overall, we are not pessimistic on the local economy, as we are not yet out of options. With surplus liquidity remaining high, there is ample room to borrow local currency without increasing inflation. This does not mean inflation will not increase – but if it does, it will not be due to increased borrowings in local currency, but rather due to shortages of US dollars and other factors related to the disruptions in supply chains brought on by the pandemic. This effectively buys T&T some time to get the right projects going. To the extent that these projects get off the ground and are targeted at (1) reducing imports and/or (2) increasing exports, thenT&T will start to see some recovery over the upcoming years.

If you have questions or would like additional information, please call us at 800-1RBC or 800-1722. We look forward to assisting you as you save towards your financial goals.

This information has been provided by RBC Investment Management (Caribbean) Limited and is for informational purposes only. It is not intended to provide investment, financial or other advice and such information should not be relied upon for providing such advice. RBCInvestment Management (Caribbean) Limited takes reasonable steps to provide up-to-date, accurate and reliable information, and believesthe information to be so when printed. Any investment and economic outlook information contained in this article has been compiled by RBCInvestment Management (Caribbean) Limited from various sources. Information obtained from third parties is believed to be reliable, but norepresentation or warranty, express or implied, is made by RBC Investment Management (Caribbean) Limited, its affiliates or any other personas to its accuracy, completeness or correctness. RBC Investment Management (Caribbean) Limited and its affiliates assume no responsibility forany errors or omissions. The contents of this article should not be considered an offer to sell to, or a solicitation to buy securities. When makingan investment decision, you should consult with a qualified financial advisor who can provide advice on the suitability of any investment for youbased on your investment objectives, investment experience, financial situation and needs, or other relevant information. Important informationconcerning the investment goals, risks, charges and expenses is contained in the prospectus. Investors should carefully consider these beforeinvesting. The Roytrin Mutual Fund prospectuses and the NAV of each fund are available on our website (www.rbc.com). Performance is subjectto variation and is likely to change over time. Past performance should not be treated as an indicator of future performance.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.