Natalie Mansoor, CPA CMA, CFA Senior Director Investment Management, for RBC Investment Management (Caribbean) Limited, the Investment Manager for the Roytrin Mutual Funds provides insights on the investment strategies adopted in managing the Roytrin Mutual Funds and market perspectives as we look ahead.

Q: 2021 has seen continued disruptions. How are the Roytrin Funds performing?

Mansoor: 2021 has had its challenges however, the outlook has become clearer and more optimistic as vaccine distribution continues globally, albeit unevenly, with a disproportionately higher share of vaccines going to richer countries. While 2020 and early 2021 were buttressed by large stimulus and support packages in developed economies, these are now winding down as the availability of a vaccine has allowed for a return to work, school and regular activities.

This recovery to “normal” has been fraught with setbacks as outbreaks of the Delta variant have caused uncertainty for governments, businesses and individuals as they seek an acceptable balance between safety and economic realities. All said, however, the recovery is well underway and has transitioned from a stimulus-supported recovery to a more self-sustaining one. Of the 22.36 million jobs shed in the U.S. over the months of March and April 2020, over 17 million have come back thus far and the unemployment rate has dropped from a record 14.8% in April 2020 to 4.8% in September 2021.

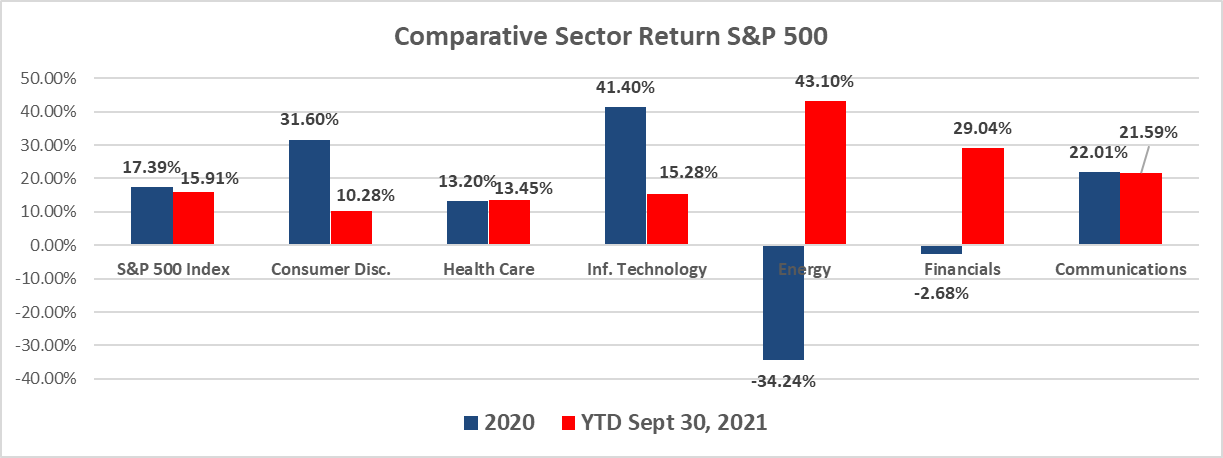

Equity markets continue to trek higher, with the S&P 500 up a further 15.91% YTD (to Sept 30, 2021) after earning 17.39% in 2020. Sectors to which Roytrin Funds have significant exposures — such as Information Technology and Consumer Discretionary — have tempered their runs in 2021 after the break-neck pace seen in 2020, while other sectors such as Energy and Financials have recovered from the losses seen in 2020, registering the greatest returns for 2021 thus far (see Graph 1). The Communications sector, which is another favoured sector, has maintained its steady, stellar outperformance.

Graph 1: source Bloomberg

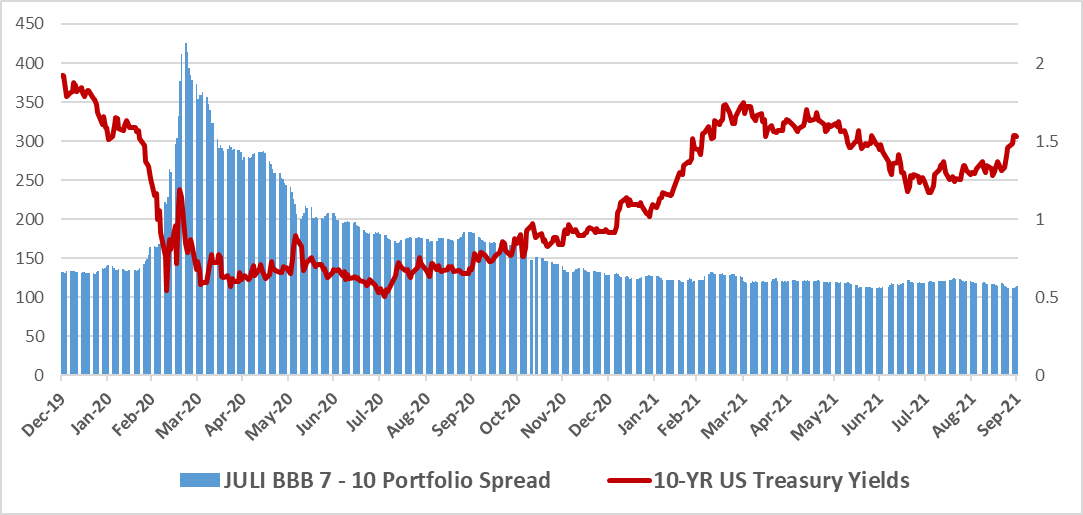

U.S. Treasury rates continue to rise, which is not unexpected as economies recover and the anticipation of the withdrawal of monetary stimulus by central banks takes over. Inflation has also been elevated as pent-up demand and supply chain disruptions cause shortages and backlogs across every major industry. In tandem with the rise in interest rates has been the continued decline in spreads as yield starvation starts to take hold (see Graph 2).

Interest rates, in absolute terms, are still painfully low, giving bond investors little to celebrate, even with defaults well below what was originally feared at the start of the pandemic. Overall, the impact of rising rates (negative for bonds) and declining spreads (positive for bonds) have offset each other leaving bond returns at levels commensurate with prevailing yields, signalling the full normalization of the bond markets from the turmoil seen in 2020.

Graph 2: Source Bloomberg

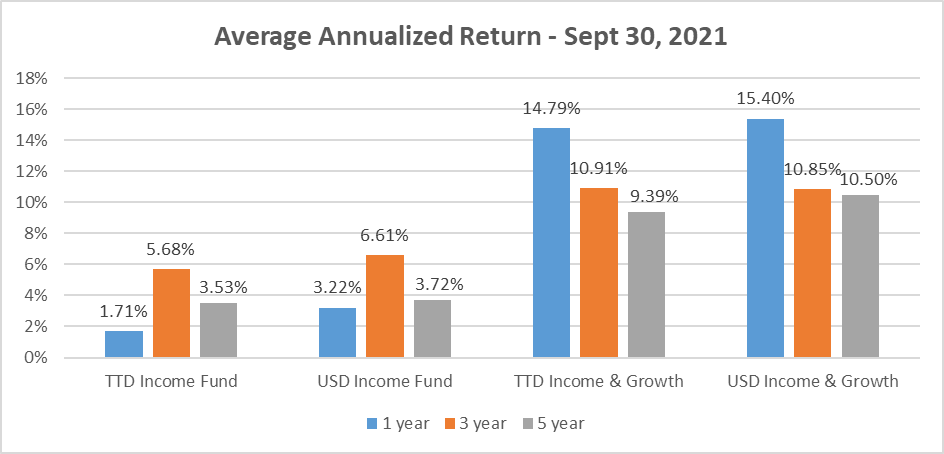

For the Roytrin Funds, we have held our position of favouring equity over fixed income. The Technology sector remains our greatest exposure even as the recovery has become more broad-based. As we have indicated prior, bonds are now back in normal territory and so returns have resumed levels reflective of the very low interest rate environment. Our strategy has succeeded, as evidenced by double-digit returns for the Income & Growth Funds and attractive returns for the Income Funds (see Graph 3).

Graph 3: source Roytrin Funds

Q: What is your outlook for the rest of 2021 and into 2022?

Mansoor: As previously stated, jobs and job creation, along with wage growth (or the lack thereof) will ultimately dictate the pace of the economy. Over the last two contractions and subsequent recoveries in the U.S., jobs created have on average been adequate to satisfy the widely accepted amount required to keep pace with population growth — but just barely.

Wages have been increasing along with overall inflation as the return to normalcy remains disjointed and fraught with setbacks. The last 18 months of disruption to production, supply chains and shipping will not resolve easily, as the duration of the disruptions has meant that a simple return to normal will not cure the backlogs. Interim measures will have to be taken, such as reductions in production (for example, instead of producing 10 lines of a product, this will be cut to five or six) as well as finding alternative and/or multiple suppliers.

We see the impact of the pandemic on supply chains lingering well into 2022 before normalizing, and that assumes there are no further serious outbreaks or new COVID-19 variants that exacerbate the situation. The impact of this on inflation, particularly wage inflation, has been significant with the headline Consumer Price Index (CPI) reaching 5.3% in July 2021 and wages increasing 4.3% YOY in July. September saw an acceleration in wages to 4.6% YOY.

Overall, inflation will persist at an elevated level, but we believe it will recede to more acceptable levels toward the end of 2022.

- The U.S. Federal Reserve will stay accommodative and will not be quick to tighten interest rates as they will want some assurance that the economy is on a solid footing.

- The talk of tapering (i.e., the gradual removal of government stimulus) has started to emerge and most investors will certainly remember the “taper tantrum” of 2015 where investors got jittery as the stimulus was withdrawn.

- We do not believe tapering to be much of an issue other than whatever temporary market reaction may ensue. There is already so much liquidity in the financial system that slowing down or even ceasing to add more liquidity at this point will have no real impact either way.

- We see the active withdrawal of liquidity — either through raising interest rates or asset sales to be several years away. After the financial crisis of 2008/09, the first interest rate increase did not occur until December of 2015, demonstrating the Fed’s willingness to be patient and even let the economy run hot for a while before they act. In this current cycle, we expect the Fed will wait until both the unemployment rate and supply chains are well back to normal before they seek to tighten policy and as such, we do not look for any significant increase in interest rates until 2023 at the earliest.

- A backup of the 10-year U.S. Treasury yields to around 1.75% – 2.00% would not surprise us and while this is significantly higher than the low we saw in 2020 of 0.53% and the current level of 1.50%. Overall, it’s still a very low-interest-rate environment.

In terms of the shape of this recovery, we have had a sharp fall-off in 2020 and are now in the midst of a sharp recovery. We expect this will lose steam eventually and growth will return to more normal levels. The last growth cycle was a flat one, with almost no acceleration and we believe this cycle will be similar, once the initial jolt is over. Overall factors that remain well in play:

- The commoditization of everything

- Demographic changes

- Increasing inequality

- Climate change.

Of these factors, climate change and growing inequality — and the responses to these factors — have the potential to spur growth beyond what we have seen in the last cycle. These along with the infrastructure spending plans currently being contemplated in the U.S., if done well, can create jobs with good pay and spur greater balance between workers and the owners of capital. So we are hopeful this growth cycle may be a bit stronger than the last one but even if it isn’t, we still expect the environment to be largely supportive for equity and neutral for fixed income.

Q: What about the local environment?

Mansoor: The Government’s success in bringing diverse and plentiful vaccination options to T&T so we can start the recovery process is to be applauded. One must appreciate the fact that the options afforded to us have been on par with what is offered in far richer countries and the extent to which the vaccine uptake is successful is the extent to which T&T will be able to have a permanent return to normalcy.

The Government’s support to the population has also been welcomed, as they have maintained jobs (even though work was not being done at normal levels) and sought to assist the unemployed via various mechanisms. This has been financed largely through debt and so the debt levels of the country have increased just as the revenues of the country (via taxes and energy sector revenues) declined. However, we believe this was the right approach, overall. The debt level, while high, has been largely local currency debt, and thus can be managed.

As we transition out of lockdown measures, the economic future of the country will depend on how we invest our monies over these next few years. To the extent that money is invested in things like renewable energy, agriculture, tourism, infrastructure and other projects that provide jobs, provide export opportunities and transition loss-making infrastructure companies into profitable ones — then we believe that T&T can have a meaningful turnaround.

Q: So how are you positioning Roytrin Funds?

Mansoor: As our outlook is for the recovery to flatten out into a low growth cycle, we believe the bulk of the broad “recovery trade” equity returns are behind us and so we have started to narrow our focus to areas that we think can continue to grow at a double-digit pace in the future, single-digit, growth environment.

We believe there will be a response to climate change as well as the issues of growing inequality. For the Roytrin Funds, we are adding exposure to key areas such as renewable energy, natural solutions (these involve the use of naturally occurring phenomena to address not only climate issues but also other issues as well), recycling, waste management, water management, agriculture technologies, alternative materials, carbon capture technologies and other solutions as well. Many of these are in different stages of development with some more pervasive than others but we believe a multi-solution approach will be needed and so we keep tabs on many areas, even if they may be currently in the early developmental stage.

We believe growing inequality will be met by increasing demand for change, as average workers grow weary of constantly bearing the brunt of every crisis (whether it’s a financial crisis, pandemic or climate events; while the rich grow richer regardless). The demand for change has already started but is currently somewhat disjointed as it now tends to revolve around specific aspects of the overall issue. We look for these to consolidate over the upcoming years using social media tools and the power of numbers and their combined economic and political power to bring about meaningful change to wages, benefits, worker protection, limitations on executive pay and many other aspects of this issue. This should result in greater consumer power, which will benefit companies that align well with these changes and ultimately companies that produce consumer goods and services and consumer-driven economies in general.

In the fixed income space, we are extending duration as interest rates rise. While we anticipate inflation will remain elevated for longer, we do not see this being demand-driven but rather a result of supply disruptions. As such, raising interest rates would not be helpful in such an environment and may indeed serve to make things worse. Even with a return to normal, with a flat growth cycle expected, we believe interest rates will be range bound and with absolute rates so low, extending duration is our preferred method of increasing yield rather than reducing credit quality.

If you have questions or would like additional information on Roytrin Mutual Funds, please call us at 800-1RBC (1722). We look forward to assisting you as you save towards your financial goals.

This information has been provided by RBC Investment Management (Caribbean) Limited and is for informational purposes only. It is not intended to provide investment, financial or other advice and such information should not be relied upon for providing such advice. RBC Investment Management (Caribbean) Limited takes reasonable steps to provide up-to-date, accurate and reliable information, and believes the information to be so when printed. Any investment and economic outlook information contained in this article has been compiled by RBC Investment Management (Caribbean) Limited from various sources. Information obtained from third parties is believed to be reliable, but no representation or warranty, express or implied, is made by RBC Investment Management (Caribbean) Limited, its affiliates or any other person as to its accuracy, completeness or correctness. RBC Investment Management (Caribbean) Limited and its affiliates assume no responsibility for any errors or omissions. The contents of this article should not be considered an offer to sell to, or a solicitation to buy securities. When making an investment decision, you should consult with a qualified financial advisor who can provide advice on the suitability of any investment for you based on your investment objectives, investment experience, financial situation and needs, or other relevant information.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.