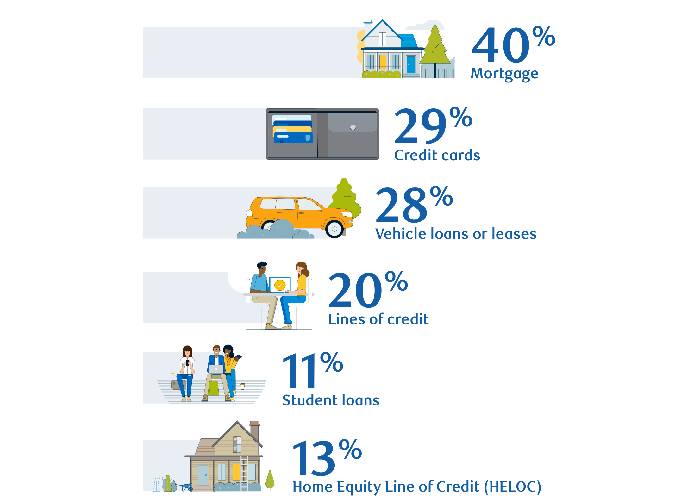

The most common type of debt for Canadians

Set a Goal, Set a Budget

The first step towards creating a schedule to pay down your debts is to set a budget and stick to it. This helpful tool can help you understand your monthly cashflow by adding up your monthly expenses, helping you visualize your position over shorter periods of time. As you go, you might even recognize opportunities to eliminate some expenses. Debt payments are part of your monthly calculations, but that doesn’t stop you from also budgeting for other purchases, such as vacations and entertainment. And remember, an important part of any budget is how much money you’re putting into your savings. Yes, even when you’re paying down debts! As long as you’re managing everything carefully, you can budget for multiple things at once.

Save For a Rainy Day

With an understanding of your budget, you can now develop a strategy to pay down your debts. As you can see in this article, there are a number of different approaches that may work for you. You can:

- Prioritize your debts with the highest interest rates

- Focus on your smallest loans and pay those off first

- Pay down the debts with the lowest interest rates first

- Consolidate your debts into a single loan with a single monthly payment

There’s no wrong way to pay down your debts, but depending on your situation, some approaches may be more efficient than others.

Set a Goal, Set a Budget

When you are setting up your budget, remember to set aside some money for your savings. It’s always a good idea to have some money put away for the future, or in case an unexpected expense comes up. Here are some tips to help you save:

- Separate your savings. Set up a separate savings account so that it’s easy to keep track of and less tempting to “borrow” from. You may also be able to find some account types that earn higher interest.

- Automate it. Set regular deposits to transfer money into your savings account, or use tools like RBC’s NOMI to help manage your finances.

- Get creative. Every dollar helps, so find those subscriptions you’re not using, eliminate unnecessary purchases, and call your cell phone and internet providers and ask for better rates.

As you start to make a plan to tackle your debt and build your savings, there is one piece of advice that never fails – don’t be afraid to ask for help. You can make an appointment to speak to an RBC advisor anytime, and get started by downloading NOMIlegal bug2 to receive alerts, reminders and tailored insights based on your banking habits so you can make more informed financial decisions.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.