It’s been said that Albert Einstein once called compound interest the “most powerful force in the universe.” Whether or not the wild-haired theoretical physicist was wowed by a savings strategy based on exponential math is debatable, but the value of compound interest is decidedly not.

As a group savings plan member, you’re already doing the hard work of making regular payroll contributions to save for your future. And if you’re not yet taking full advantage of your group savings plan, understanding the powerful force of compounding may change your mind! Since you work hard for your money, your money should be working hard for you. Welcome to compounding.

What Is Compounding?

Compounding interest can be officially defined as “interest on interest.” Unofficially, think of it as letting your money do the hard work for you. With compounding, you earn interest on your initial savings, and when that interest is reinvested, you then earn interest on the new total.

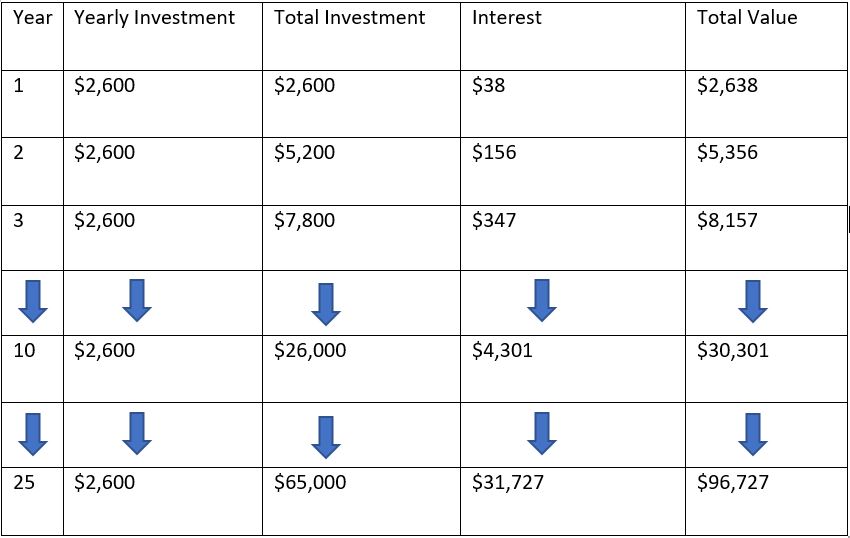

Here’s a straight-forward example of compounding for someone making regular bi-weekly payroll contributions of $100 over a period of 25 years at a guaranteed rate of 3 per cent interest.

*Results calculated using the RBC RRSP Calculator. The results generated by the calculator are general estimates only and provided for informational purposes.

The longer your time horizon, the more significant the impact. It’s a perfect example of how slow and steady wins the race. But even in those early years you can start to see the magic happen! And that’s even before taking into account any matching contributions that your employer may offer. Taking advantage of any matching contributions can really kick compounding into high gear, helping you meet your financial goals faster.

BONUS: Investing a fixed dollar amount on a regular basis can also help you reduce the risk that comes with trying to time the market. Known as dollar-cost averaging, it’s a simple investing strategy that involves investing a fixed dollar amount on a regular basis regardless of market conditions. The idea is that while you will pay more for some of your investments (when markets are rising) and less for others (during market downturns), the overall amount per share will average out in the end – and ideally will total less than you would have paid had you purchased at one set price.

Finding the Space and Time

While it’s unlikely that Albert Einstein spent much time thinking about compound interest with that whole theory of relativity likely taking up so much time (and space!), understanding the “powerful force” of compounding can be a huge motivator to help you stay on track with your savings goals and achieve them faster.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.