Natalie Mansoor, CPA CMA, CFA Senior Director Investment Management, for RBC Investment Management (Caribbean) Limited, the Investment Manager for the Roytrin Mutual Funds provides insights on the investment strategies adopted in managing the Roytrin Mutual Funds in the midst of the COVID 19 pandemic and the medium term outlook.

Q: The COVID-19 pandemic has had a devastating impact, both from a health and economic perspective. How have you managed the Roytrin suite of mutual funds through these difficult times?

Our overall strategy is rooted in 4 key themes and expectations:

1.The commoditization of everything: this speaks to the increasing use of technology to create efficiencies and reduce cost, in so doing, impacting the number and quality of jobs being lost and created. This has implications for consumption and inflation, because at the most basic level, people cannot consume if they do not have a source of income and the level of income a person earns influences what and how much is consumed.

2.Demographic changes: aging populations have and will continue to change the landscape of consumption. Declining birth rates will have an even greater impact, as most countries have birth rates below replacement rate. Despite living longer, at some point, older generations will die and we will need more live births to sustain or increase the global population. Without this, populations will start to decline which will have a significant impact on economic growth, inflation and consumption.

3.Increasing income inequality: this is one of the major consequences of #1. The implications here are social as well as economic and they affect consumption and consumption-driven economies.

4.Declining local economy: demand for fossil-fuel based energy started moderating more than a decade ago, just as the U.S. was poised to start its ramp-up in production from shale. With the continued heavy reliance on oil and gas revenues, the T&T economy was expected to be challenged and will continue to be challenged.

The COVID-19 pandemic has had devastating economic impacts – none of which we expect to be contrary to or in conflict with our key expectations. If anything, the pandemic will likely serve to accelerate and intensify these trends; for example, we expect companies will emerge from this pandemic seeking to further improve efficiencies and reduce costs. This benefits companies who are already far along in the development of their technological usage and companies that are in the business of helping other companies implement improved efficiencies.

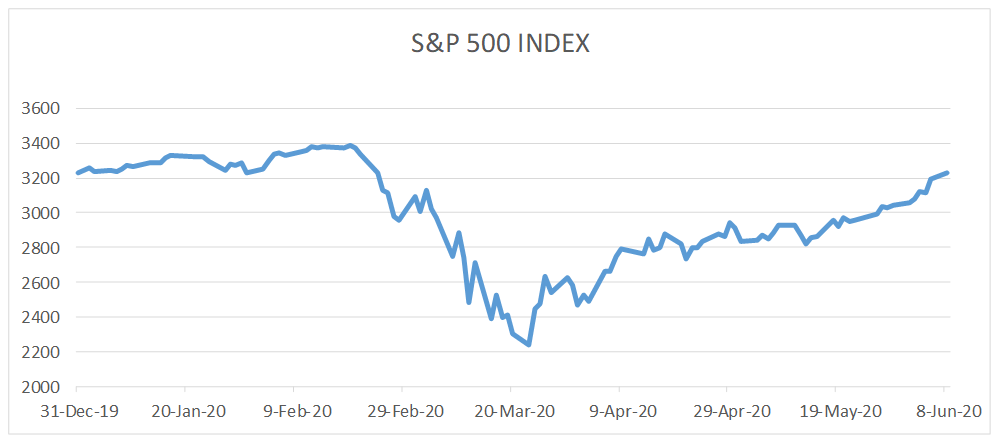

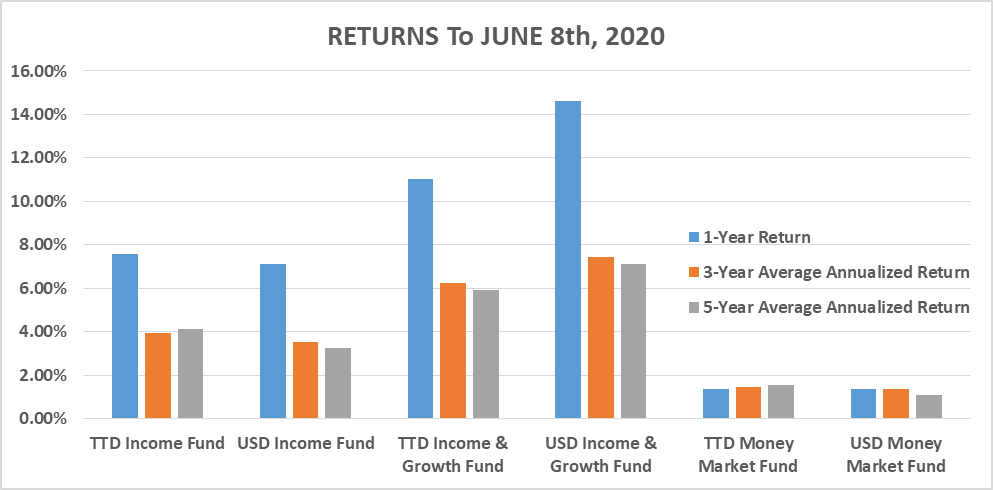

Consequently, we sought to add to our positions in March and April as markets declined and assets got particularly cheap. Our tactical strategy is always to buy assets cheap and sell them when they get expensive. As markets declined we viewed it as a buying opportunity to pick up great stocks and bonds at bargain prices. The S&P 500 fell to 2,237.4 on March 23rd but has since rebounded 42.75% off this low to Jun 5th. Overall, the S&P 500 is down 1.14% YTD while our USD Income & Growth Fund is up 2.92% YTD. This speaks to the benefits of buying when prices are cheap, as one gains a higher portion of the rebound return than you would get otherwise. Overall, the USD Income & Growth Fund is up 14.61% over the last year, despite the pandemic.

The impact on bonds has been similar – again our strategic outlook, based on our key themes, has been for subdued economic growth along with tepid inflation. The post-pandemic world will be no different, and likely will be more challenged than before to generate strong GDP growth and positive inflation. We continue to be unafraid of rising interest rates and used the displacement in the market during March and April to add good quality, long-duration bonds at very cheap prices. Overall, the TTD Income Fund is up 1.85% YTD and 7.57% over the last year to June 5th.

Q: What is the outlook going forward and where will investment returns come from in the next 5 – 10 years?

We expect the COVID-19 pandemic will be resolved over the next few years and economies will start the recovery process. Recovery will not be even, as we expect richer economies will be able to provide more support and stimulus versus poorer countries. Even so, certain industries and behaviours will be forever changed. That said, we do not expect any deviation from our original strategic outlook. Over the next 5 to 10 years the global conversations will be centred on income inequality, climate change, inclusion, protectionism and demographic changes – in particular aging populations and declining birth rates. Each of these issues has far-reaching implications for countries, economies and markets, which present opportunities but also increase the risk of a global recession or at the very least, a lack of acceleration in growth.

So for example, climate change can be devastating, wreaking havoc on crops, property and loss of life. On the flip side, we expect there will be substantial investments made by governments, corporations and individuals to address climate issues. There are companies that are well-positioned to benefit from this, such as companies that focus on recycling, green energy, carbon reduction, as well as numerous other technologies that may now be in developmental phase but have the potential to become more pervasive over the next decade.

Income inequality is and will continue to be one of the key issues that will not go away lightly and has the potential to lead to significant social unrest as we have already seen in a few countries. Here, governments and companies have an opportunity to get in front of these challenges through legislation, taxation and policies that prepare and support their citizens to be equipped with the skills needed for human jobs of the future and ensure the dignity of work is maintained. Consumers will have an increasing say on this issue, using social media to coordinate action, voting with their wallets for the companies and brands they chose to support or boycott, as the case may be. We see an opportunity to align with companies with the foresight to voluntarily “do the right thing” rather than being forced into it through social pressure or legislation.

Demographic changes will also become a greater focus over the next decade. Aging populations have long been apparent, but what is rarely discussed is the fact that most countries, outside of Sub-Saharan Africa, currently have birth rates below the critical 2.1 replacement level. Positive population growth is a fundamental assumption of most economic models because this is what the world has experienced. The world population is still growing, not through new births, but by delayed deaths as people are living longer. As a result, we are ill-equipped to understand or adjust to the implications of a declining world population. Regardless, it is safe to say the economic impact will be significant, as population growth drives much of the growth in consumption. As the age profile of the world evolves, it will create opportunities in certain areas: not limited to healthcare. We need to start thinking about what the needs and wants of an older, more vibrant population might look like, including for example the recreational activities that would appeal to this demographic, their specific financial needs and social connections, etc. It’s in these spaces that we will find opportunities for growth.

If you have questions or would like additional information, please call us at 800-1RBC or 800-1722. We look forward to assisting you as you save for your financial goals.

This information has been provided by RBC Investment Management (Caribbean) Limited and is for informational purposes only. It is not intended to provide investment, financial or other advice and such information should not be relied upon for providing such advice. RBC Investment Management (Caribbean) Limited takes reasonable steps to provide up-to-date, accurate and reliable information, and believes the information to be so when printed. Any investment and economic outlook information contained in this article has been compiled by RBC Investment Management (Caribbean) Limited from various sources. Information obtained from third parties is believed to be reliable, but no representation or warranty, express or implied, is made by RBC Investment Management (Caribbean) Limited, its affiliates or any other person as to its accuracy, completeness or correctness. RBC Investment Management (Caribbean) Limited and its affiliates assume no responsibility for any errors or omissions. The contents of this article should not be considered an offer to sell to, or a solicitation to buy securities. When making an investment decision, you should consult with a qualified financial advisor who can provide advice on the suitability of any investment for you based on your investment objectives, investment experience, financial situation and needs, or other relevant information.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.