Financial markets are constantly fluctuating. Currencies, bond prices, stock prices, commodities and Interest rates change constantly in response to economic data releases, geopolitical events, monetary policy decisions by Central Banks, company news and Acts of God, among other factors. Most recently we’ve seen the effects on the market of the COVID-19 pandemic, when the financial markets experienced a sharp decline in March. Although fluctuations in asset prices affect all mutual funds, only floating NAV mutual funds provide investors with transparency on the true value of their holdings in the fund. Floating NAV are in line with international best practice and allows investors to benefit from an additional avenue of wealth creation, in the form of capital gains.

To demonstrate the benefit that transparency brings, we can examine the performance of the TT dollar Roytrin mutual funds.

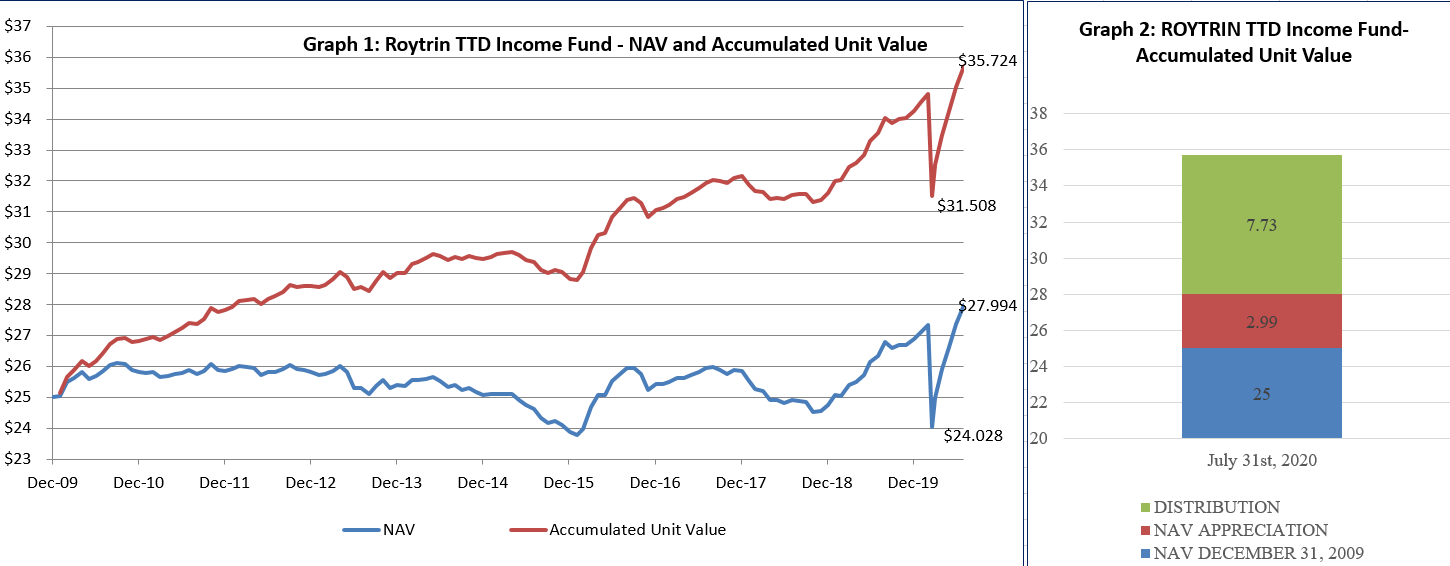

Firstly, the Roytrin TTD Income Fund has recovered and even surpassed its pre-COVID-19 high, benefiting from record low U.S. interest rates (see graph 1). The accumulated value of a Roytrin TTD Income Fund unit (which is the NAV plus all distributions) reached TT$35.72 as at the end of July 2020. It is important to include the distribution impact when evaluating this Fund: while some investors tend to focus on the NAV only, note that most of the return on this Fund comes from its monthly distributions of income (see graph 2).

Since Jan 1, 2010, when the Roytrin TTD Income Fund commenced operating on a floating NAV basis, the Fund has made cumulative distributions to date of TT$7.73 per unit. This is more than twice the NAV appreciation alone of TT$2.99 and is in keeping with the mandate of the Fund, which is to generate income.

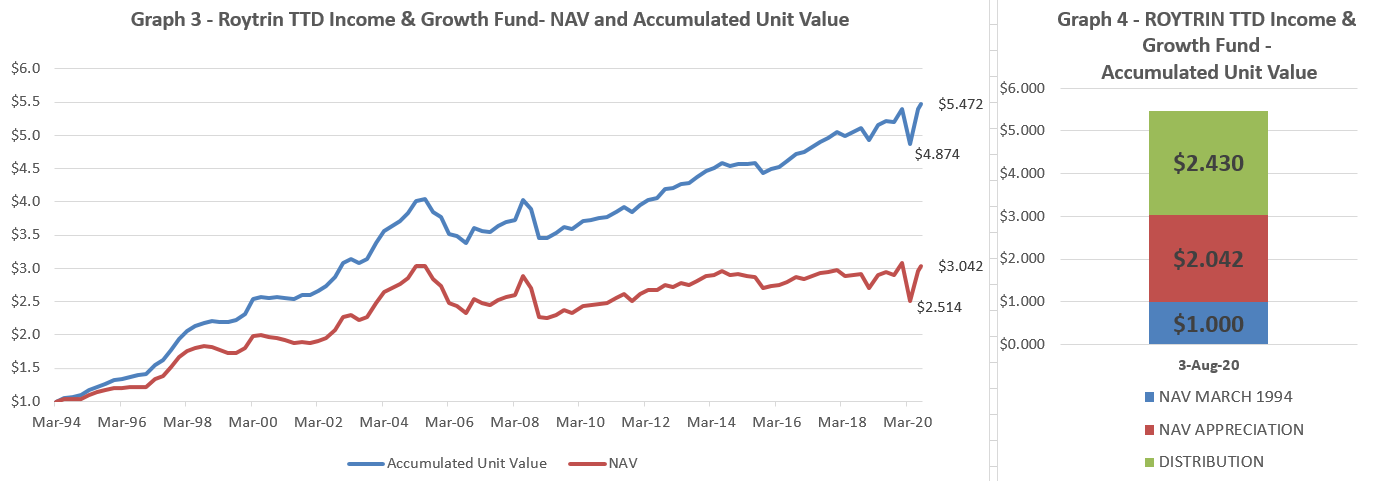

The TTD Income & Growth Fund is a bit different in that the capital appreciation contributes a greater portion of the accumulated unit value. See graphs 3 and 4. The cumulative distributions made since inception of the TTD Income & Growth Funds totals TT$2.43 per unit while the capital appreciation is TT$2.04 per unit. The distribution represents interest and dividends earned as well as realized capital gains.

Market Outlook:

With all major equity markets approaching their pre-COVID highs (the Nasdaq has already surpassed this level and is making new highs), there is concern that the equity market is overvalued, particularly in light of record unemployment and heightened uncertainty over the direction of the global economy. It must be noted however, that markets are forward-looking and are based on expectation much more than on current or historical factors. Our expectations going forward are for a very slow recovery, marked by sluggish, uneven growth, low interest rates and low inflation.

Equities will remain well supported by low interest rates, however, stock selection will be key as the recovery in equity prices has been irregular, with some sectors still in decline. For example, the S&P Energy sector and S&P Financials sector are still down 36.79% and 20. 68% YTD to Jun 30, 2020. By contrast, the Information Technology sector and Consumer Discretionary sectors are up 22.86% and 16.63% respectively. As we look forward, we believe technology companies have further to run, despite how much they have already climbed, because the growth outlook is much brighter, both on an absolute and a relative basis. As long as one believes that the current trends in technology will continue: i.e. growth in e-commerce, AI, cloud applications, big data analytics etc. then there is no reason to exit this sector, even if there is a pullback in price. A pullback would just represent an opportunity to buy more, in our opinion.

On the other hand, we do not see the growth outlook for cyclical sectors like Financials and Energy as being particularly attractive. Without strong economic growth driven by robust, accelerating consumption, these sectors will continue to struggle. To be clear, it’s not that they will decline in value, but on a relative basis, they will likely not be able to grow their businesses at the same pace as other companies.

Low interest rates will be the norm for the foreseeable future and so bond investors will need to temper their expectations. Credit quality will be more important than ever, as many companies racked up record levels of debt during the last cycle and will struggle to remain solvent in the post-COVID environment. That being said, spreads are within normal range and going forward, we believe that there is room for spreads to compress further, as interest rates stay low (and negative in some cases) and investors become starved for return.

If you have questions or would like additional information, please call us at 800-1RBC or 800-1722. We look forward to assisting you as you save towards your financial goals.

This information has been provided by RBC Investment Management (Caribbean) Limited and is for informational purposes only. It is not intended to provide investment, financial or other advice and such information should not be relied upon for providing such advice. RBC Investment Management (Caribbean) Limited takes reasonable steps to provide up-to-date, accurate and reliable information, and believes the information to be so when printed. Any investment and economic outlook information contained in this article has been compiled by RBC Investment Management (Caribbean) Limited from various sources. Information obtained from third parties is believed to be reliable, but no representation or warranty, express or implied, is made by RBC Investment Management (Caribbean) Limited, its affiliates or any other person as to its accuracy, completeness or correctness. RBC Investment Management (Caribbean) Limited and its affiliates assume no responsibility for any errors or omissions. The contents of this article should not be considered an offer to sell to, or a solicitation to buy securities. When making an investment decision, you should consult with a qualified financial advisor who can provide advice on the suitability of any investment for you based on your investment objectives, investment experience, financial situation and needs, or other relevant information

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.