This article originally appeared on RBC Wealth Management on May 2024.

As a medical professional, you may have created a medical professional corporation (MPC) to manage your income and wealth. Canada’s recently unveiled 2024 federal budget proposes to increase the capital gains inclusion rate to 66.67% from 50%. This article focuses on the impacts this change may have on your MPC and considerations for selling securities before June 25, 2024.

For a more robust discussion of the extensive impacts of these proposed changes on individuals, corporations, estates, trusts and more, please ask your RBC advisor for the comprehensive article titled “2024 Federal Budget – Planning for the proposed increase to the capital gains inclusion rate.”

While the budget document outlined the capital gains changes in a general way, there are still many unanswered questions given there was no accompanying draft tax legislation on the changes. The government stated that additional design details will be released in the coming months. As of the date of writing, Quebec is the only province or territory that has announced its intention to harmonize with the federal increase.

The effects of the proposed changes on MPCs

The capital gains inclusion rate is the rate applied to a capital gain to arrive at the taxable capital gain, which is included in taxable income. The budget proposes that all capital gains realized in a corporation on or after June 25, 2024, will have an inclusion rate of 66.67%. As further clarification, there’s no 50% inclusion rate available to corporations for the first $250,000 of capital gains.

With the increase in tax on the first dollar of capital gains realized in the corporation, the difference in the corporate tax rate on eligible dividends versus capital gains is much lower in every province and territory. For example, before the increase in the inclusion rate, in Alberta, the tax rate on capital gains is 23.34% versus 38.33% on eligible dividends. After the increase in the inclusion rate, the tax rate on capital gains is 31.11% versus 38.33% on eligible dividends.

Further, when comparing the combined corporate and personal tax rates on capital gains earned through a corporation to the top marginal tax rate on capital gains earned personally, there’s a significant tax cost to earning the capital gains through the corporation, especially where the shareholder may benefit from the 50% inclusion rate on the first $250,000 of capital gains (e.g., in Alberta, 34.36% vs. 24% on the first $250,000 of capital gains).

It’s not yet known whether the refundable portion of taxes paid by a corporation on passive investment income will be adjusted to allow for better integration given the proposed capital gains inclusion rate changes.

Before taking action: ask “big picture” questions

It’s important to consider the power of tax deferral as one of the fundamental tools of tax planning. A tax deferral takes advantage of the time value of money. All else being equal, the longer your tax can be deferred, the less the discounted present value of your tax liability. For example, $25,000 in tax deferred for 20 years at an assumed 5% interest rate has a discounted present value of $9,422. With a tax-deferred investment strategy, the money that might otherwise go to pay current taxes remains invested for greater long-term growth potential and benefits from the power of compounding. In other words, selling now will result in a pre-payment of tax and a smaller after-tax amount to reinvest. Given the importance of tax deferral, before acting, it may be helpful to revisit your goals and timelines before making a change.

Considerations for selling securities before June 25

If, in your regular review of your MPC’s portfolio, you determine that a portfolio rebalancing is appropriate, consider whether to implement the rebalancing before the increase to the inclusion rate. Keep in mind that the trades would need to settle before June 25; therefore, ensure trading dates are factored in to meet this deadline. This way, any capital gains triggered from the rebalancing would be subject to the current 50% inclusion rate.

For securities you’ve not previously considered disposing of this year or next, the decision to sell should be analyzed with a detailed cost/benefit analysis based on your MPC’s specific circumstances to determine the “break-even holding period.” This is the point in time when, assuming all other things being equal, the MPC’s after-tax portfolio value will be the same regardless of whether it sells prior to June 25, or maintain the portfolio and sell in the future.

Break-even analysis example

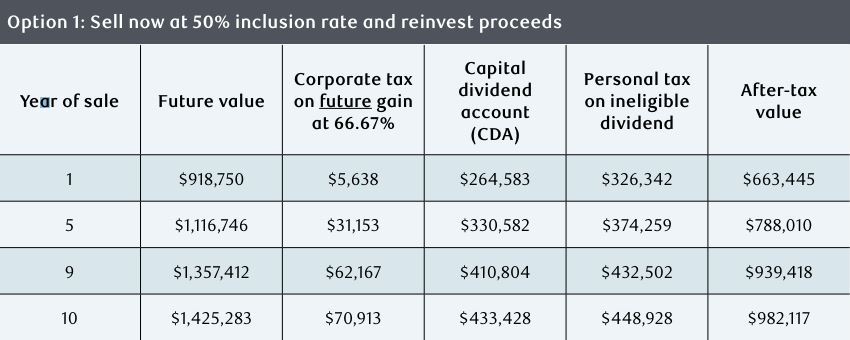

Let’s look at an example of a corporation selling securities before June 25 at the 50% inclusion rate and investing the proceeds, versus holding the security until a future date and selling when the inclusion rate is 66.67%.

Let’s assume:

- The fair market value of the securities is $1,000,000 and the adjusted cost base of the securities is $500,000.

- The MPC’s tax rate is 50% and the shareholder’s tax rate is 45% on ineligible dividends.

- The expected future rate of return is 5% (100% deferred capital gains, no interest, no dividends).

- Alternative minimum tax (AMT) does not apply.

If the MPC were to sell today, it would be subject to capital gains tax of $125,000, leaving it with only $875,000 of after-tax proceeds for reinvestment. Alternatively, the MPC could hold/not sell and keep the full $1,000,000 invested. It’s assumed the shareholder will withdraw the proceeds from the sale of the portfolio after the break-even period as a combination of taxable ineligible dividends and tax-free capital dividends.

The following table shows the difference in after-tax value between selling now at the 50% inclusion rate versus holding and selling the security at a future date at the 66.67% inclusion rate.

The preceding table shows the shareholder can expect the difference in after-tax value to be the same sometime between the ninth and 10th year. Therefore, if the MPC expects to keep the securities and the shareholder will not extract the funds for at least 10 years, they will be better off not selling now and rather, holding the investment. In other words, if the MPC plans to hold the security for less than 10 years and the shareholder will be withdrawing the proceeds, they will be better off to sell before June 25 at the 50% inclusion rate.

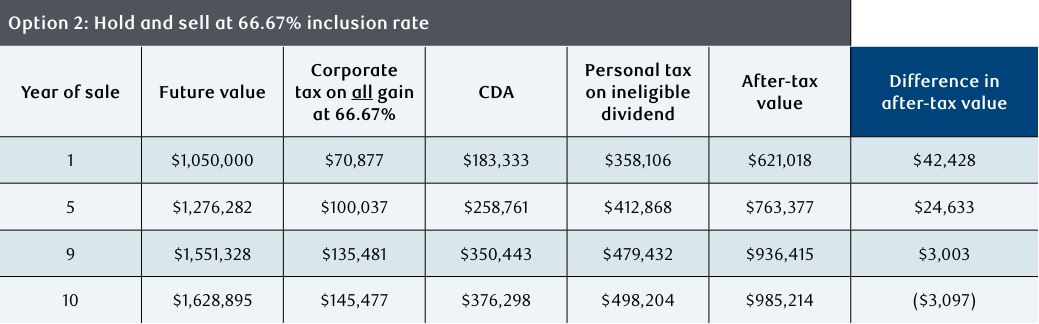

The following table shows the break-even holding period for the preceding example using the same assumptions but at various capital growth rates of return.

If you’re deciding whether to sell before June 25 or continue to hold, important considerations will be the expected rate of return, your investment time horizon and the potential incremental capital gains tax.

The lower the future expected rate of return, the longer the break-even holding period will be. Conversely, the higher the future expected rate of return, the shorter the break-even holding period. As such, if you hold a security with a higher rate of return and you plan to hold on to this security for the long term, it likely doesn’t make sense to sell just to take advantage of the lower inclusion rate.

Consider the timing for realizing capital losses

When selling securities in your MPC, capital losses will reduce capital gains realized in the same taxation year. For tax purposes, there appears to be no benefit to proactively realizing capital losses before June 25 in order to realize losses at the 50% inclusion rate. There also appears to be no downside to waiting to realize the loss on or after June 25 at the 66.67% inclusion rate.

Consider the impact on the capital dividend account (CDA)

The CDA is a notional account which tracks amounts that private corporations are allowed to pay as tax-free dividends to their shareholders. The non-taxable portion of the capital gains realized in a corporation increases the CDA, while the non-allowable portion of capital losses immediately reduces the CDA. For a capital gain (loss) realized prior to June 25, the non-taxable (nonallowable) portion added to (subtracted from) the CDA is 50%. In contrast, a capital gain (loss) realized on or after June 25 will have a non-taxable (non-allowable) portion of only 33.33% added to (subtracted from) the CDA, resulting in a smaller tax-free amount that can be paid to shareholders. If you’re considering realizing capital gains in your MPC before June 25, you should consider immediately paying out a capital dividend if the CDA is positive, as any future capital losses triggered will reduce the existing CDA balance.

Consider the impact on your MPC’s access to the small business deduction (SBD)

If you intend on realizing a significant amount of capital gains in your MPC prior to June 25 to benefit from the 50% inclusion rate, it’s important to consider the impact of doing so on your MPC’s access to the SBD. There are rules that restrict access to the SBD for Canadian controlled private corporations (CCPCs) that have passive investment income over $50,000, which includes taxable capital gains. Certain provinces, such as Ontario and New Brunswick, don’t follow these rules for provincial tax purposes. You should consult with a qualified tax advisor to determine whether realizing a significant amount of capital gains in your corporation would impact its SBD based on your MPC’s specific situation as well as its province/territory of residence.

Conclusion

Given the 2024 federal budget proposal to increase the capital gains inclusion rate, and in continuing to proactively plan for the future, it’s important to discuss your MPC’s situation with your qualified tax advisors to understand the significance of the potential impacts and determine if it makes sense to take action prior to June 25, 2024.

+ Disclaimers

This article may contain strategies, not all of which will apply to your particular financial circumstances. The information in this article is not intended to provide legal, tax or insurance advice. To ensure that your own circumstances have been properly considered and that action is taken based on the latest information available, you should obtain professional advice from a qualified tax, legal and/or insurance advisor before acting on any of the information in this article.

This document has been prepared for use by the RBC Wealth Management member companies, RBC Dominion Securities Inc. (RBC DS)*, RBC Phillips, Hager & North Investment Counsel Inc. (RBC PH&N IC), RBC Wealth Management Financial Services Inc. (RBC WMFS), Royal Trust Corporation of Canada and The Royal Trust Company (collectively, the “Companies”) and their affiliates, RBC Direct Investing Inc. (RBC DI)* and Royal Mutual Funds Inc. (RMFI). *Member – Canadian Investor Protection Fund. Each of the Companies, their affiliates and the Royal Bank of Canada are separate corporate entities which are affiliated. “RBC advisor” refers to Private Bankers who are employees of Royal Bank of Canada and mutual fund representatives of RMFI, Investment Counsellors who are employees of RBC PH&N IC, Senior Trust Advisors and Trust Officers who are employees of The Royal Trust Company or Royal Trust Corporation of Canada, or Investment Advisors who are employees of RBC DS. In Quebec, financial planning services are provided by RMFI or RBC WMFS and each is licensed as a financial services firm in that province. In the rest of Canada, financial planning services are available through RMFI or RBC DS. Estate and trust services are provided by Royal Trust Corporation of Canada and The Royal Trust Company. If specific products or services are not offered by one of the Companies, RBC DI or RMFI, clients may request a referral to another RBC partner. Insurance products are offered through RBC Wealth Management Financial Services Inc., a subsidiary of RBC Dominion Securities Inc. When providing life insurance products in all provinces except Quebec, Investment Advisors are acting as Insurance Representatives of RBC Wealth Management Financial Services Inc. In Quebec, Investment Advisors are acting as Financial Security Advisors of RBC Wealth Management Financial Services Inc. RBC Wealth Management Financial Services Inc. is licensed as a financial services firm in the province of Quebec. The strategies, advice and technical content in this publication are provided for the general guidance and benefit of our clients, based on information believed to be accurate and complete, but we cannot guarantee its accuracy or completeness. This publication is not intended as nor does it constitute tax or legal advice. Readers should consult a qualified legal, tax or other professional advisor when planning to implement a strategy. This will ensure that their individual circumstances have been considered properly and that action is taken on the latest available information. Interest rates, market conditions, tax rules, and other investment factors are subject to change. This information is not investment advice and should only be used in conjunction with a discussion with your RBC advisor. None of the Companies, RMFI, RBC WMFS, RBC DI, Royal Bank of Canada or any of its affiliates or any other person accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or the information contained herein. In certain branch locations, one or more of the Companies may carry on business from premises shared with other Royal Bank of Canada affiliates. Notwithstanding this fact, each of the Companies is a separate business and personal information and confidential information relating to client accounts can only be disclosed to other RBC affiliates if required to service your needs, by law or with your consent. Under the RBC Code of Conduct, RBC Privacy Principles and RBC Conflict of Interest Policy confidential information may not be shared between RBC affiliates without a valid reason. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © Royal Bank of Canada 2024. All rights reserved.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.