Practically speaking, lenders are likely to require a business plan if you need start-up cost funding to finance your medical practice or clinic. However, securing financing is only the beginning of the reasons to create a business plan.

A solid medical practice business plan can also help you:

- Build a fulfilling and right-sized roster of patients through geographic, demographic and competitive research

- Plan for appropriate space that also takes growth projections into account

- Determine the people and skills you will need to run an efficient practice

- Make educated income and expense projections

- Allow all stakeholders to collaborate in shaping the future of the practice

- Create an exit plan (even if that exit might be decades down the road)

What goes into making a great medical practice business plan?

A solid plan starts with preparation. Here are some essential to-dos to complete before sitting down to write your medical practice business plan:

1. Get your credentials and licensing in order

Start paperwork early since some licensing requirements may take several weeks or months. The specific requirements may vary depending on the type of practice you’re operating and its geographical location.

A few of these items may include:

- Medical certifications and licenses for your province

- Professional association memberships

- Insurance

- Credentialing and hospital privileges

2. Conduct preliminary market research

Conducting market research can help you create a profitable and personally rewarding practice. Before writing your medical practice business plan, consider the following:

- The volume and types of practices in your geographical location

- The demographics and health of the local population (e.g., Are there any prevalent or underserved chronic diseases? Is the population growing?)

- The average cost to lease or buy space and transportation/parking surrounding available options

- The proximity of complementary services, such as diagnostic facilities, hospitals, etc.

With preliminary details carved out, you’ll be in a better position to assess viability before creating a more detailed plan.

3. Assess costs and make projections

With rising overhead costs, physicians should spend time getting an accurate idea of the typical costs associated with opening a medical practice or clinic.

An estimate at this stage might include the following:

- Rent and utilities

- Renovations, if necessary

- Staffing

- Furniture, medical equipment, office equipment, etc.

- Licensing and association dues

- Technology, such as an EMR, Practice Management Software and billing software

- Insurance

- Marketing

- Advisors such as lawyers, accountants, bookkeepers, etc.

- Service needs, if applicable, such as janitorial, laundry, maintenance, sharps disposal, landscaping and snow removal, etc.

- Miscellaneous costs include staff training, periodicals, office supplies and stationery, signage, etc.

What to include in a business plan

Once you have most of these details at hand, you’re ready to create a business plan for your practice or clinic. A template can provide an excellent guide; however, a simple document containing the following sections is typically sufficient:

- Executive summary. Write a brief overview that covers the important points of your business plan at a glance. The executive summary should not exceed 10% of your plan’s length (e.g., one page for a 10-page plan). It can be helpful to think of this section as your brief pitch — and even though this section appears first, many entrepreneurs like to write this section last.

- Participants. Include a description of the people involved in the practice, such as yourself and other care providers or partners.

- Your practice profile. Describe the services your practice will provide in brief. If a growth model is relevant, you may include it here.

- Market research. Include what you have discovered about the current marketplace, including what you know about competing providers, any relevant underserved needs, patient demographics and population growth. You can also include a profile for your typical or ideal patient here.

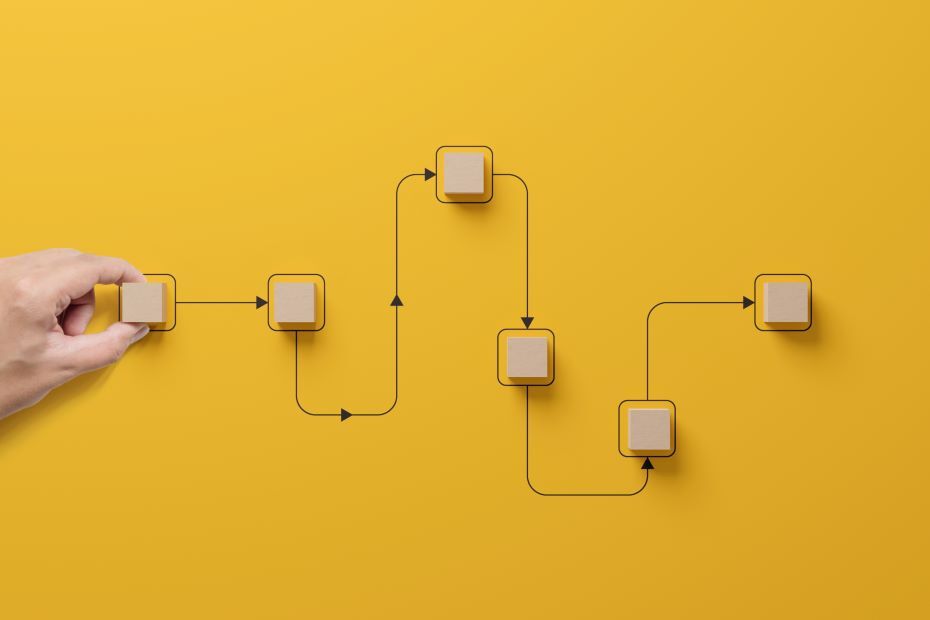

- Implementation plan. Create a timeline starting from creating your business plan to opening your doors. Describe how you intend to build your patient roster (e.g., marketing plan).

- Projections and budget. Outline your expected expenses and revenue in as much detail as you currently can. Try to predict at least the first 12 months.

- Exit plan. An exit strategy is the one part of your plan you will likely not share with investors. However, it’s important to consider how you will transition, retire or recoup your investment, even if it’s years down the road.

Ready to take the next step?

Starting a medical practice or buying out an existing practice can be both challenging and rewarding. A detailed business plan can act as your GPS as you navigate the journey.

Don’t forget to factor in your own fulfillment as you create your plan. What works for the business should also work for you personally regarding location, risk tolerance, nearby professional and personal networks, roster makeup and more. If your practice fulfills you professionally and personally, it’s all the more likely to be successful.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.