A version of this article originally appeared on RBC Wealth Management Insights.

Key reasons for the market’s retreat were supply chain constraints and their knock-on effect on inflation. The problems have been present and well known for many months, but they have become exacerbated recently. It’s possible they may not abate anytime soon.

While COVID-19 prompted many of the supply chain bottlenecks, there are other factors:

- A sharp increase in demand for goods: As the global economy re-opened after being nearly shut down in 2020, demand surged. Supply chains aren’t built for this. Also, the pandemic has sparked lifestyle changes as household spending has shifted more toward goods and away from services. Consequently, shipping volumes from Asia to North America are up 27% compared to pre-pandemic levels, according to RBC Global Asset Management (RBC GAM).

- Labour shortages in a variety of industries: This has occurred for multiple reasons, including ongoing concerns about COVID-19 risks, a mismatch between job openings and qualified applicants, and perhaps changes in career goals and priorities helped along by the pandemic. In August, the proportion of the American workforce that voluntarily quit their jobs surged to the highest level on record going back to 2001.

- Low supply of container ships: The shipping industry was running low on ships even before the pandemic. Over many years, the number of shipyards worldwide has dropped 63 percent since the previous peak level in 2008, according to RBC GAM. More ship capacity will likely go offline as new regulations come into force in 2023 that will require ships to be retrofitted for environmental purposes.

- High shipping costs: The most widely followed measure of container shipping costs, published by research firm Drewry, indicates that while container prices have retreated a bit so far in October, they are still up 283% from a year ago.

- Abnormally long processing times at ports: Shortages of longshore workers and increased demand for goods have backed up container and ship positioning. When ships sit idle off the coast it reduces the number of trips they can take, and the backlog mounts.

- Truck driver shortages: Land-based transportation systems are having difficulty processing the large volume of containers stacked up at ports because of the COVID-19-related shortages of truck drivers, particularly in North America.

- Lean inventories: Global supply chain problems quickly become consequential and multiply when inventories are tight. Moreover, because the problems are well known, orders for raw materials, component parts, and finished goods are now being placed earlier than normal, which is lengthening the queue, creating a vicious cycle, RBC GAM points out.

- Energy price spikes: This problem has surfaced more recently, and could persist through the winter, at least. Two examples: Chinese manufacturing has been constricted by power shortages and rationing due to high coal prices and the government’s power consumption limits; and, the surge in natural gas spot prices in Europe has hampered the fertilizer industry, which impacts agricultural production and prices. Power bills for businesses and households are on the rise in Europe and Asia.

- The UK’s own unique problems: Brexit labour rules that place restrictions on EU workers have hobbled distribution channels. Separately, trade frictions between the UK and EU are at risk of heating up in the coming months over the Northern Ireland protocol, which could cause another set of supply chain challenges.

The global versus equity market impact

The bottlenecks are unlikely to disappear overnight. A month ago, RBC Elements conducted a digital intelligence study that indicated 77% of the major ports it monitors were experiencing abnormally long turnaround times, and that the overall global problem was trending “unequivocally worse.”

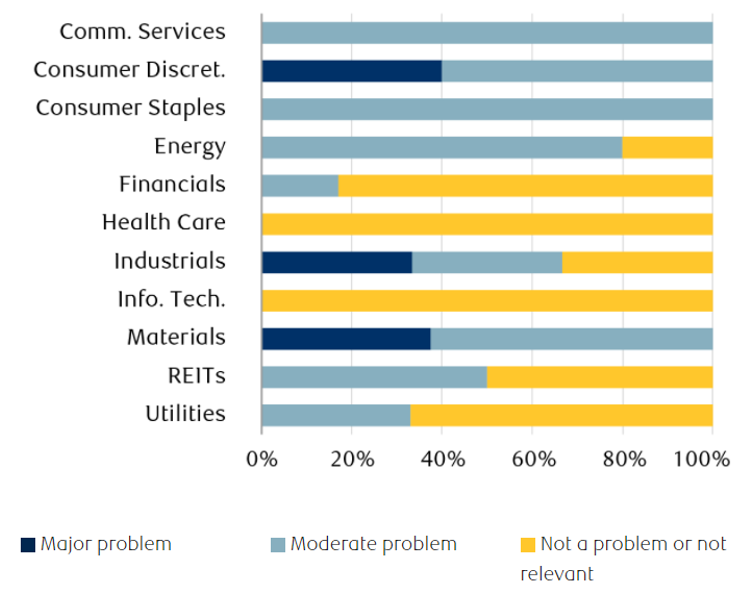

But there is an important distinction to be made between the impact on the global shipping industry and the impact on U.S. stock market sectors. Some sectors are experiencing major-to-moderate supply chain problems (Consumer Discretionary, Materials, and Industrials), while other sectors are not experiencing problems (Health Care and Information Technology), according to a survey of RBC Capital Markets equity analysts. The remaining six sectors seem to be coping and fall somewhere in between, as the chart illustrates.

Supply chain headwinds most prominent for Consumer Discretionary, Materials, and Industrials

Survey of RBC Capital Markets equity analysts: How would you characterize supply chains for your industry?

Source: RBC Capital Markets U.S. Equity Strategy, RBC Capital Markets estimates; sector scores are derived from industry scores in the relevant sectors. Survey conducted in late September/early October 2021.

RBC GAM’s chief economist Eric Lascelles anticipates supply chain problems could persist another six months to a year. It will take time to resolve the labour supply-demand mismatch. Some firms have already warned that bottlenecks could last into 2023.

Ongoing supply chain pressures will likely be a headwind for economic growth and have knock-on effects on inflation over the near term and possibly midterm. However, Lascelles anticipates that once supply chain pressures ease — with the increase in shipping costs and product input shortages eventually abating — this should end up being a deflationary and pro-growth force for the U.S. and global economies.

No easy fixes

As long as supply chain problems don’t worsen meaningfully or drag on for an extended period, we think the overall impact on corporate profits and the equity market will be contained. But this issue is one of the reasons inflation may remain elevated in North America and will rise in Europe and Asia, equity market volatility may persist and returns might be more muted in the next twelve months.

This article was originally published on rbcwm.com

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.