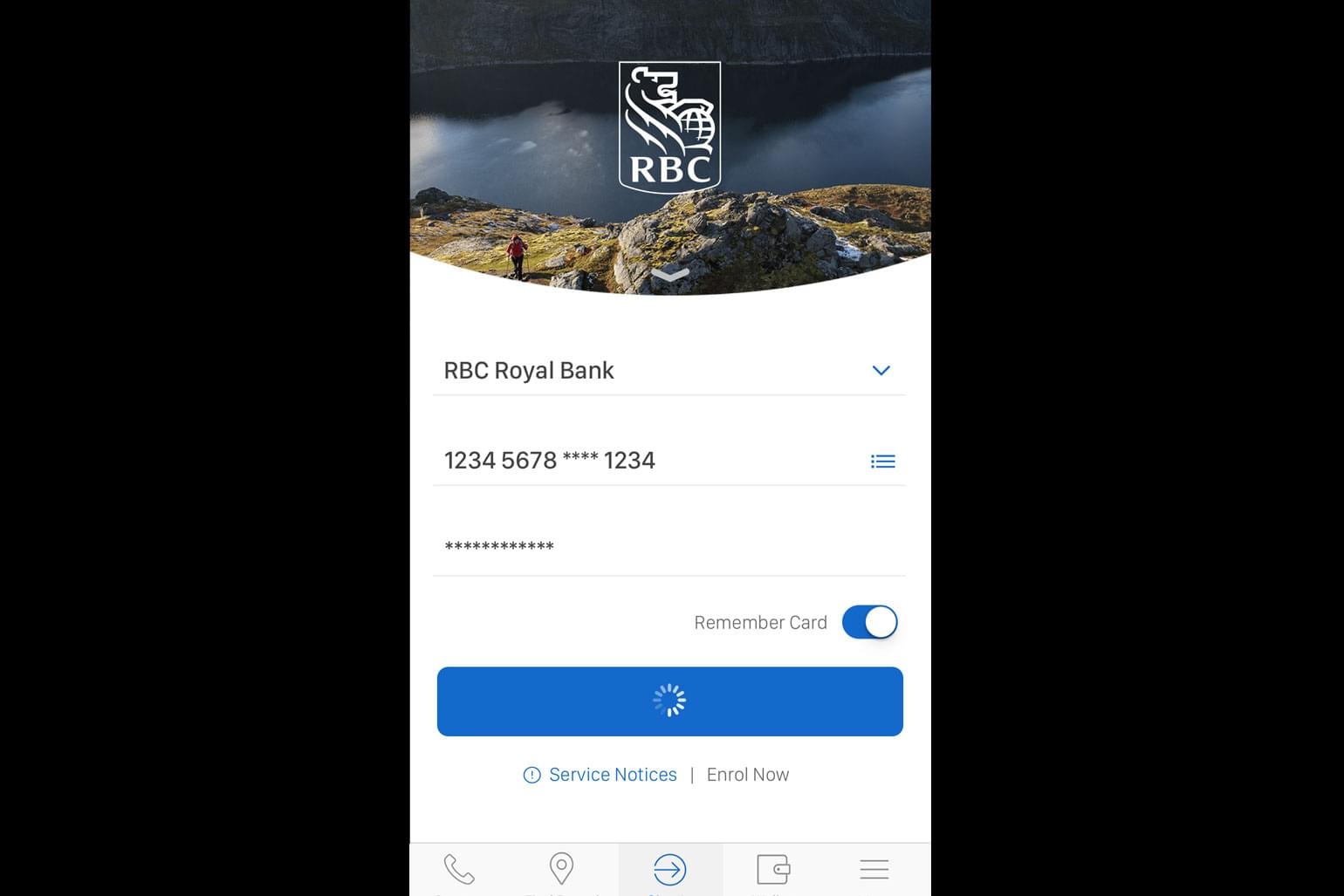

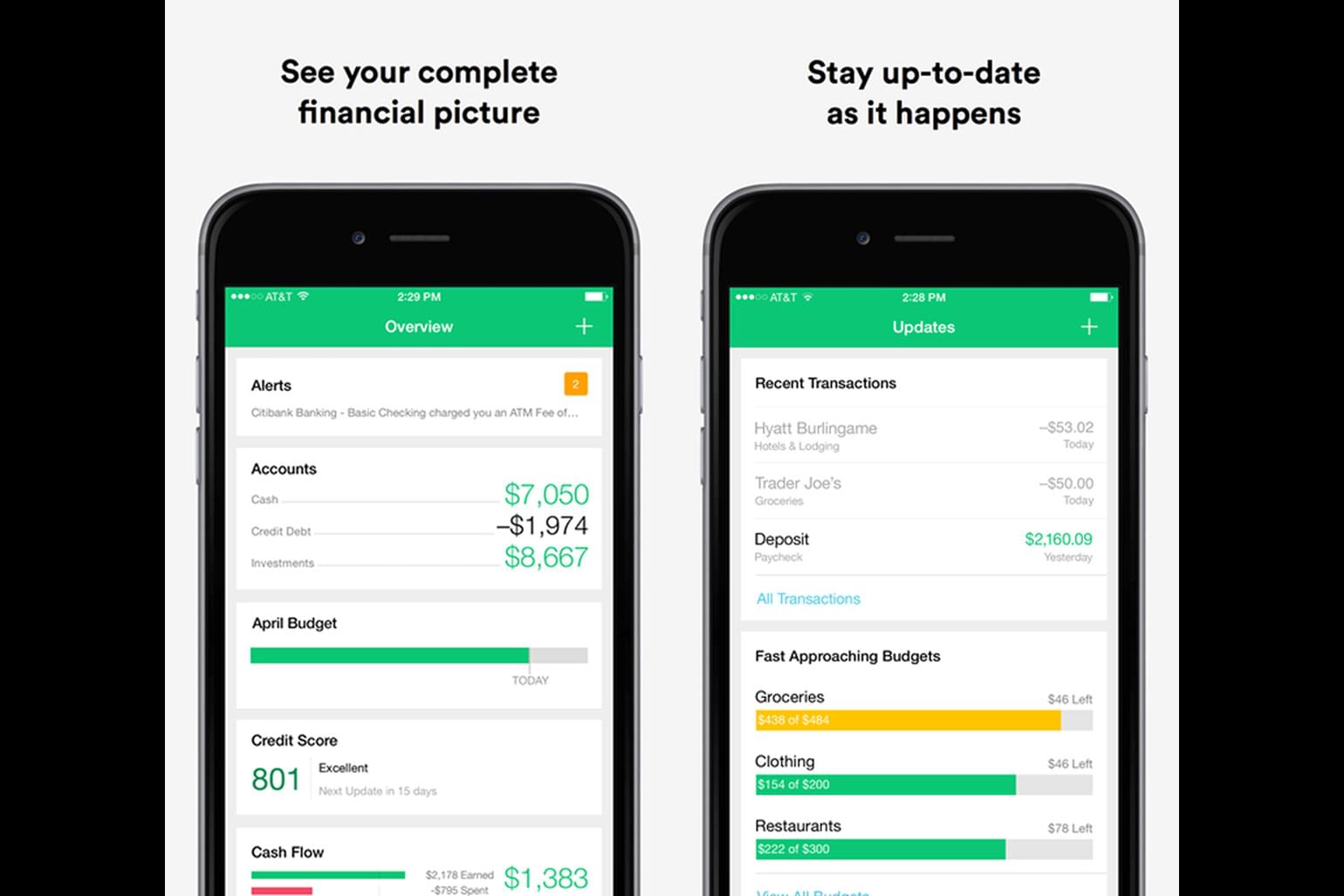

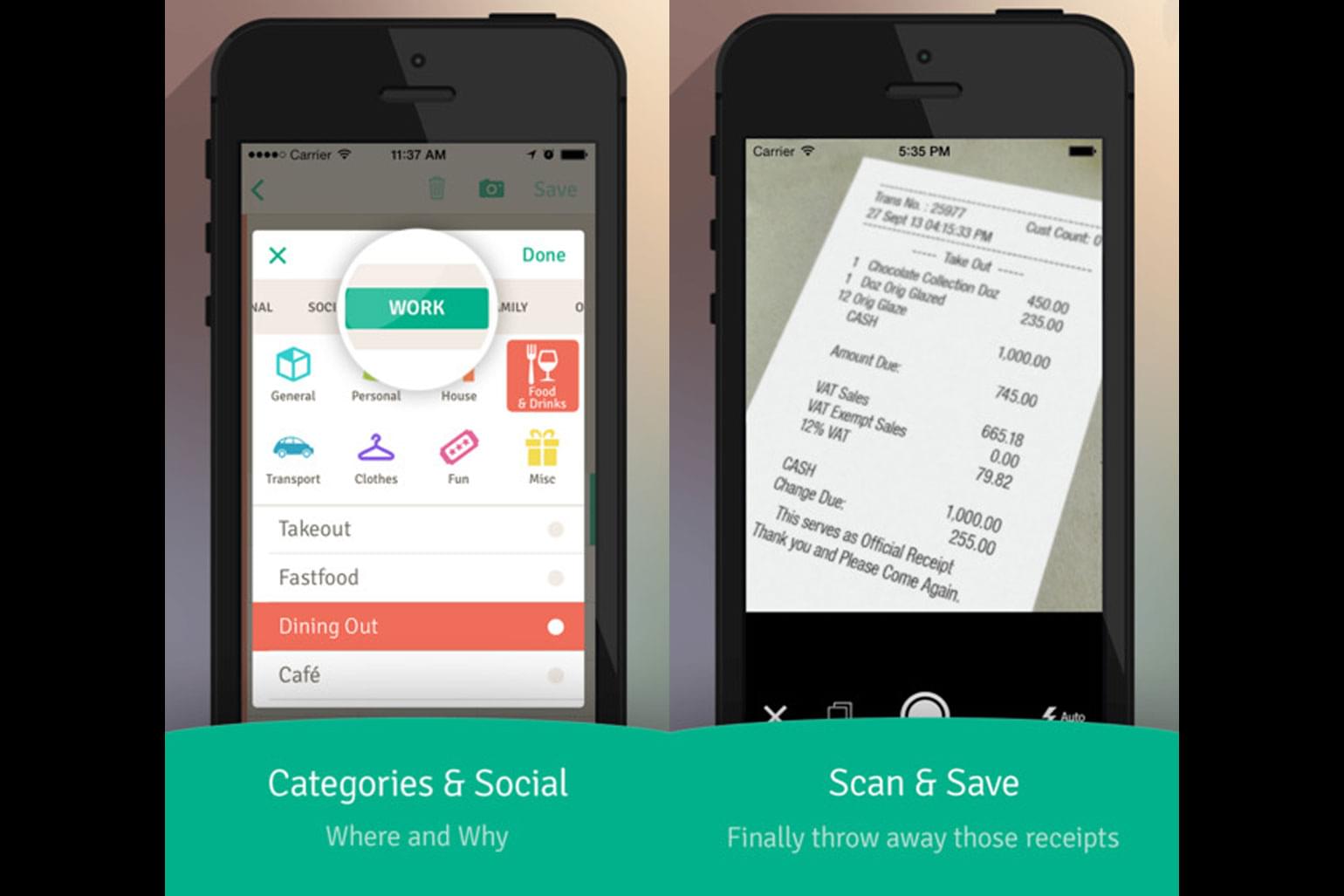

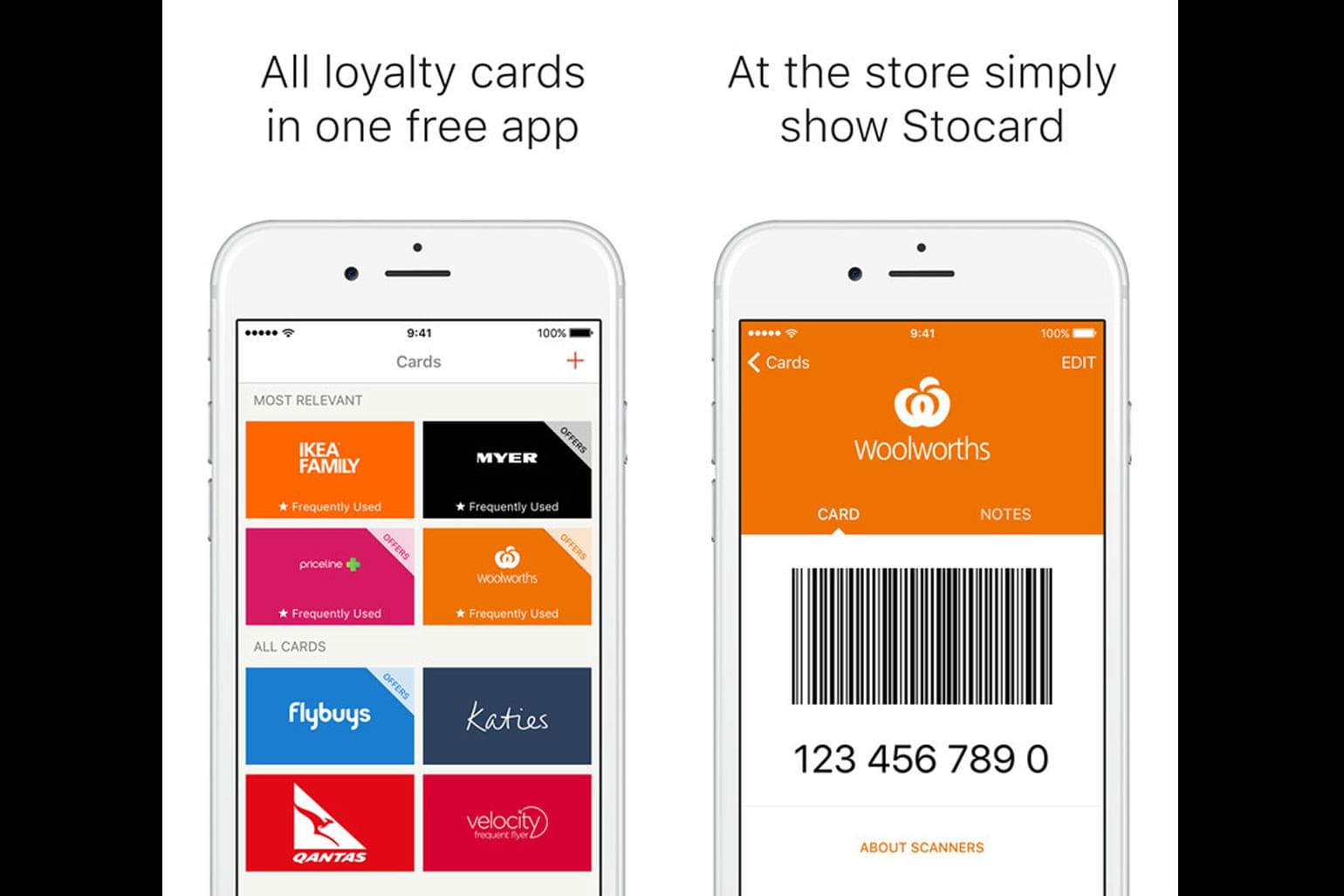

Whether you're a busy parent juggling multiple bills, you work for yourself and are keeping track of expenses, you're paying down a hefty mortgage or student loan, or you simply want to manage your money on the go, there's a mobile app for that. Start holding yourself financially accountable. Here are five mobile budget and money management apps you'll want to download today:

‡Apple and Touch ID are trademarks of Apple Inc., registered in the US and other countries. All other trademarks are the property of their respective owner(s).

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.