Published April 11, 2023 • 4 Min Read

A version of this article was originally published by RBC Global Asset Management.

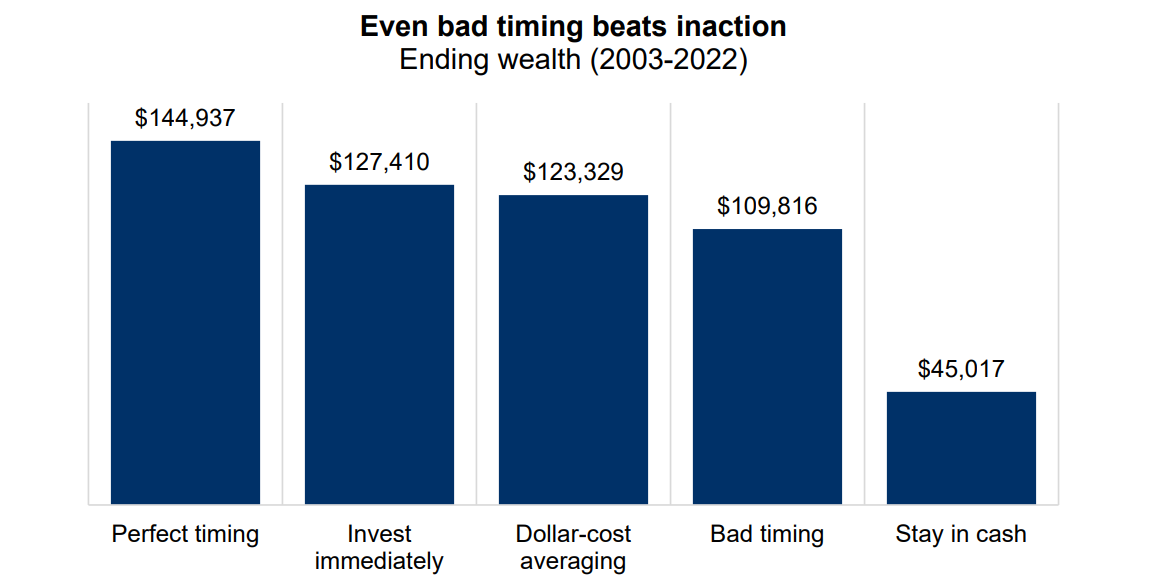

Many investors wonder if there is a “right time” to invest. The team at RBC Global Asset Management ran the numbers to compare five different investing approaches. Here’s what they found about timing the market.

In today’s topsy-turvy economy, many investors are weighing the risk of recession and what that might mean for financial markets and personal investment portfolios. After all, market conditions shape many of our investing decisions — whether it’s handling a year-end bonus or tax return (invest now or wait?) or choosing between setting up a pre-authorized contribution plan or investing a lump sum.

Here’s the big question: Is there a good rule of thumb investors can follow when it comes to timing our investment decisions? Our partners at RBC Global Asset Management (GAM) ran the numbers on market timing and the results are clear.

Comparing five different approaches

Let’s look at five hypothetical investors with different approaches – and results. Each received $2,000 at the beginning of every year for the last 20 years and chose to invest. Here’s how they differed:

-

Perfect Pamela was a fortunate market timer. Through perhaps some skill, but surely a lot of coincidence, she was able to place her $2,000 into the market every year at the lowest closing point.

-

No-delay Dakota took a simple, consistent, and repeatable approach. Every year on the first trading day of the year, they invested their $2,000 in the market.

-

Monthly Myriam used dollar-cost averaging to invest her annual amount over 12 equal monthly contributions.

-

Bad-timing Brigette had the worst timing imaginable. She invested her $2,000 each year at the market’s highest point. She would usually see her portfolio decline in value immediately after making her annual contribution.

-

Sideline Sandro left his money in interest-earning cash investments every year. He was always worried stocks might go lower as soon as he invested, and so never got around to investing in markets at all.

As you’ll see in the chart below, it’s what happens over time that tells the full story.

Source: Morningstar, RBC GAM. Based on $2,000 invested annually based on the stated approach. Performance based on S&P 500 Total Return Index CAD-Hedged. ‘Stay in cash’ assumed investment in FTSE Canada 30 Day T-bill Index. This graph does not reflect transaction costs, investment management fees or taxes. If such costs and fees were reflected, returns would be lower. An investment cannot be made directly into an index.

The results are in:

-

Pamela’s “perfect timing” led to the best results. She accumulated $144,937.

-

Understanding that perfect timing is impossible without the benefit of hindsight, Dakota’s results are perhaps of most consequence. By following a simpler approach of investing at the start of each year, they came in second with $127,410.

-

Myriam’s dollar-cost-averaging approach came in third with $123,329. That’s just a little bit behind Dakota’s strategy of investing first thing each year. This is not a surprise. Markets fluctuate over time and tend to trend upward over the long term, so stretching her investments over each year meant Myriam tended to participate in a bit less of that growth than Dakota.

-

Despite her less-than-ideal timing, Brigette’s results are surprisingly encouraging. While her terrible timing left her behind the other stock market investors, Brigette still nearly tripled her wealth compared to if she had not invested at all.

-

Sandro’s results stand out for the wrong reasons. By continually waiting for a better opportunity to invest, he fared worst of all. His biggest fear had been investing at market highs. Ironically, doing exactly that would have left him with more than twice the wealth than remaining on the sidelines.

Avoid sitting on the sidelines

While we looked at the last 20 years here today, the results are quite consistent over time. The order of who gained most may differ slightly from time to time. But investing at the start of each year never came in last – it usually remained in second place or moved just to third.

Remember that without a crystal ball or the benefit of hindsight, it’s nearly impossible to time the market perfectly. Sooner is most often better. But a winning strategy for many investors involves building a plan and investing regularly. Dollar-cost averaging can be a nice middle-of-the-road strategy for those who would find a lump-sum approach too stressful or who may be worried about bad timing.

Visit www.rbcgam.com for more insights from RBC Global Asset Management.

Investment advice is provided by Royal Mutual Funds Inc. (RMFI). RMFI, RBC Global Asset Management Inc., Royal Bank of Canada, Royal Trust Corporation of Canada and The Royal Trust Company are separate corporate entities which are affiliated. RMFI is licensed as a financial services firm in the province of Quebec.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article