Published June 6, 2019 • 5 Min Read

For many, budgeting is kind of a scary word, invoking visions of hard work, tricky spreadsheets and rigorous rules that limit your fun and freedom. But the thing is, budgeting doesn’t have to be difficult or time consuming — nor does it have to mean cutting out the things you enjoy. Rather, budgeting puts you in control of your day-to-day spending and financial future by making you more aware of where your money is going.

For HGTV Canada’s Sarah Baeumler, budgeting is an essential part of her financial routine, and has allowed her and her family to manage through the tight times, save for what’s important, and reach meaningful goals.

Here are some of the ways budgeting has helped Sarah manage her money — and how it can help you free up extra dollars, save for your goals and live a financially healthy lifestyle.

Spend Less on the Things You Don’t Need

“Like many families, our children love to play games on their ipads when we are travelling. However, we quickly realized that small in-app purchases quickly add up when multiplied by four children,” Sarah says.

Setting a budget with each child for the amount of games or in-app purchases they can make has helped to teach them about money management on a smaller scale and has also helped us to curb spending.

For grown-ups, a budget can help you see where your money is going. This is where the early magic happens — you’ll soon realize you’re spending $9.99 month on a subscription or app you forgot about, or you see how your casual visits to the coffee shop are amounting to a small fortune.

A budget isn’t about cutting out the stuff you love — it’s finding where you’re spending on things that aren’t important to you.

Pay down Debt Faster

By categorizing your expenses — including your day-to-day costs, monthly bills, rent/mortgage and your debt — you’re bringing more awareness to your financial obligations. Your debt — and the interest you’re paying to carry it — may become something you feel compelled to address, rather than hide from.

Once you’ve seen your current financial picture, you’ll be able to identify where you might cut back so you can direct more money to paying down your debt and reducing your interest costs.

Spend Where It Counts

“Budgets are not written in stone,” Sarah says, “They are a guide to help you achieve all of your life goals and provide support and direction when you need it.”

Finding it tough to set money aside to save? By cutting back on expenses that don’t support your goals, you can steer more funds to your savings and reach your financial goals sooner.

“Bryan and I have always set goals for ourselves. Whether it be for places we hope to travel, or career goals we wish to accomplish — our plans always require a budget. The important thing to remember about a budget is that it is a living document that must continuously be adapted and altered each year or even each month.”

Spot Problems Early – and Adjust

Are your expenses beginning to outpace your income? Have a few unexpected costs popped up recently? Before your account drops dangerously low or your credit card balance balloons, your trusty budget will show you if things are trending the wrong way. A budget eliminates unpleasant surprises, allowing you to take corrective action when needed and stay ahead of the game.

Stay Focused

The thing with a budget is that it’s not a one-and-done kind of exercise. For it to work you need to check in with it and see how you’re tracking to your spending objectives. This regular review can help you avoid overspending and keep you focused on your financial goals — whether it’s saving for something important or becoming debt-free.

With the right tools, this routine check-in doesn’t have to be a lot of work — or even initiated by you. Apps that track your budget for you and send you updates on how you’re doing can let you stay on top of things without the work.

“Over this past year, I have relied on automated budget tools to help manage our expenses in Canada as well as manage the additional costs of this year of business abroad. By using an automated system, it’s allowed me to keep track of both our personal and business expenses while living outside of Canada and has provided us with a sense of comfort that nothing will slip through the cracks,” Sarah says.

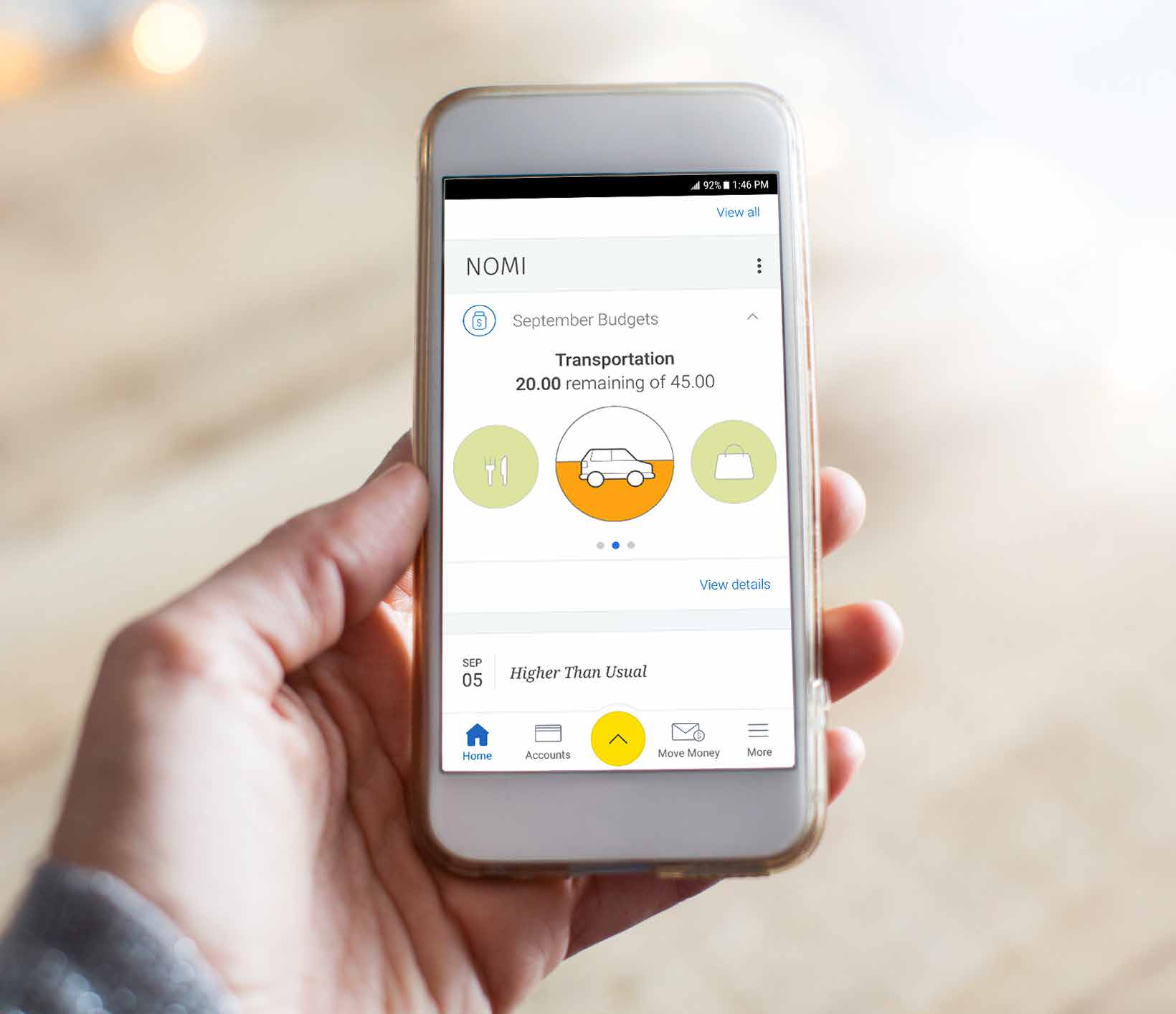

NOMI Budgets takes the math out of managing your money by doing the thinking for you. It recommends personalized budgets for you based on your spending and helps you stay on track by sending you updates along the way. Check the latest RBC Mobile app to get started.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article