Published June 21, 2023 • 4 Min Read

This article was published with files from RBC Global Asset Management.

Market volatility is an inevitable part of investing. Geopolitical events, inflationary pressures and changes in interest rates are some of the many reasons that cause markets to fluctuate, sometimes drastically.

When markets shift, particularly when they drop quickly, it can be hard not to react. But history shows you will more likely achieve your long-term investment goals if you have a plan and stick to it through all types of market conditions. This may sound easy, but investors have been put to the test recently. Veering off course from a carefully thought-out plan can have long-reaching consequences, including actual (realized) losses on your investments.

Volatility is defined as the price movement of an investment. The more the price changes, the greater the volatility. For example, an investment whose price shifts between +7 per cent and -5 per cent in one year is more volatile than an investment whose return fluctuates between +3 per cent and -2 per cent over a year.

The reality is that all investments, even cash, include some level of volatility – in general, cash is not very volatile while some stocks, or equities, can be more volatile.

Here are five strategies that can help you reduce the impact of these changes – and feel more confident about reaching your long-term goals.

1. Maintain discipline

Making dramatic portfolio changes, like moving in and out of the markets, can have a negative impact on achieving your long-term investment goals. Because it’s impossible to “time the market” (know the best time to buy or sell an investment), staying invested can help weather the volatility. There’s an old investing adage: Time in the market is more important than timing the market.

Learn more about why it’s best to stay invested.

2. Diversify your portfolio

Diversification, where you hold a mix of investments, has long been considered the golden rule of investing. It remains key to helping you navigate the inevitable ups and downs in the market, and reducing your overall risk. Learn more about why it’s important to spread your investments across different asset classes and even different countries.

3. Regularly rebalance

Market swings – even smaller ones – can often cause a shift in the mix of investments you hold in your portfolio (also known as portfolio drift). This can lead to a different mix of investments than you originally intended. Let’s say for example, 40 per cent of your portfolio is invested in equities and over a couple of up-market years, they grow by 10 per cent per cent. This changes the overall mix of your portfolio so it has a higher proportion invested in equities, which may not align with your broader approach.

If you are a self-directed investor, at RBC Direct Investing, for example, you probably keep an eye on drift within your portfolio. At RBC InvestEase, portfolios are automatically be rebalanced. And if you work with an advisor, you should talk to them if you have questions about how this works in your case to ensure your portfolio remains in tune with your needs.

Learn more about the impact of portfolio drift.

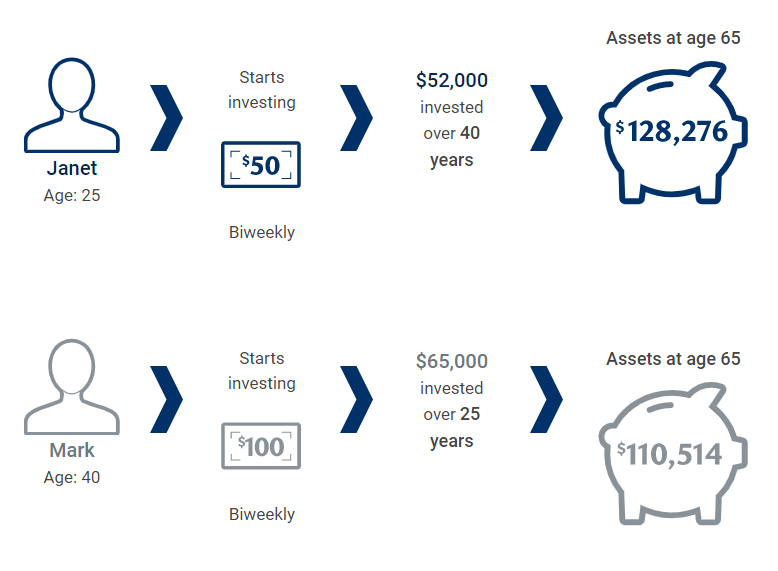

4. Use time to your advantage

One investing rule of thumb is to start as early as possible. That’s because time is one of the most powerful elements in your investment plan.

The above example is for illustrative purposes only and not indicative of any investment. Account value in this example assumes a 4% annual return. Source: RBC Global Asset Management Inc.

Learn about the power of compounding and how regular savings can really add up.

5. Invest regularly

Investing a fixed amount on a regular basis helps keep your investment plan on track through all types of market conditions. See the example below to get a sense of how regular investments can add up over time.

Assumes a 5% Annualized rate of return. Source: RBC Global Asset Management Inc. The rate of return is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the mutual fund or returns on investment in the mutual fund.

Learn more about how dollar-cost averaging works and why it’s important to pay yourself first.

Financial planning services and investment advice are provided by Royal Mutual Funds Inc. (RMFI). RMFI, RBC Global Asset Management Inc., Royal Bank of Canada, Royal Trust Corporation of Canada and The Royal Trust Company are separate corporate entities which are affiliated. RMFI is licensed as a financial services firm in the province of Quebec.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article