The director of RBC’s Financial Planning Centre of Expertise offers some guidance.

By Inspired Investor Content Team

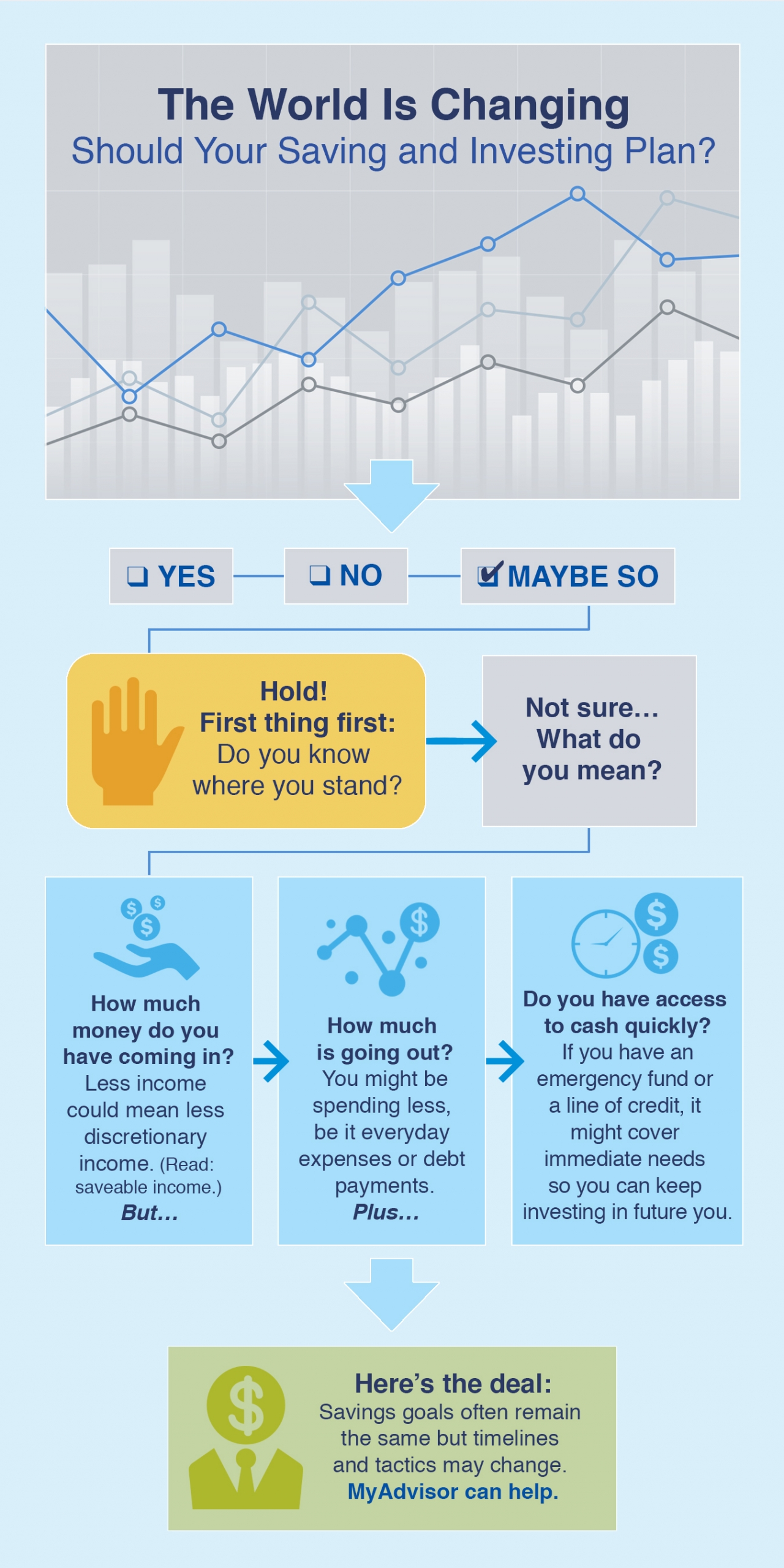

Your reality has more than likely changed in the past several weeks. You may be wondering, should your saving and investing approach change, too? And what does this mean for things happening soon that you were savings for, like paying off your credit card balance in full or buying that big-ticket item? And how about things a little farther away, like setting aside enough for a down payment on a home or creating a nest egg for retirement?

Do you need to make a change in how you’re saving and investing now? Stuart Gray, director of RBC’s Financial Planning Centre of Expertise, says the short answer is maybe. There are things everyone should be thinking about, but for the best response for your personal situation, you really need to review your finances—which can be easier than you might think.

Here are some things to consider.

- Money coming in: Has your monthly income changed? To determine how much cash is coming in every month, take into account your regular paycheque or income-replacement payments, and consider any funds that might flow in from things like a side hustle.

- Money going out: For many, spending has likely changed – think: savings in parking fees or commuting, pausing childcare or suspending your gym membership; grocery or takeout costs, on the other hand, may have gone up. Plus, government and other policies are offering some relief on debt repayment (for example, some student loan repayments have been suspended). Whatever your situation, hold yourself accountable, says Gray. Now is a good time to develop or uphold good habits. It can be easy to get off track with money habits during a disruption like we’re currently in, so it’s a good idea to scrutinize line by line where your money is going. Bucket expenses into essentials (need to have) and non-essentials (nice to have). Remember that any dip in funds going out of your account could alter how much discretionary income you have for other uses, including a saving and investing plan that keeps you on track for future you.

- Available money: If you have some money squirreled away, you may have an additional financial lever to pull during these uncertain economic times. If not, this might be the time to start putting something away, even if you start small. Importantly, says Gray, regardless of the short-term situation, savings goals often remain the same but timelines and tactics may change. An advisor can help.

Taking stock of your finances regularly is a good start to figuring out a plan to save for future you.

Ready to get started? To learn more or to discuss your personal financial situation or even to just ask questions, book a call now, or if you’re an existing RBC client you can do so through MyAdvisor.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.