Published May 31, 2022 • 5 Min Read

This article was originally published by RBC Global Asset Management.

Key takeaways

-

Inflation represents the gradual rise in prices over time. It results in a decrease in purchasing power.

-

A diversified portfolio of equities and bonds can help mitigate inflation risk.

-

Companies’ revenues and earnings typically outpace inflation over time. Bonds can provide stability against equity market volatility.

Whether you’re saving for education, retirement or another long-term goal, it’s important to be aware of inflation risk – that is, the risk that inflation will erode the value of your investments over the long term. Here’s a guide to understanding the forces behind inflation, and how diversification can help you protect the value of your money.

What is inflation?

Simply put, inflation is the increase in prices over time. The inflation rate measures how prices have changed over a period of time.

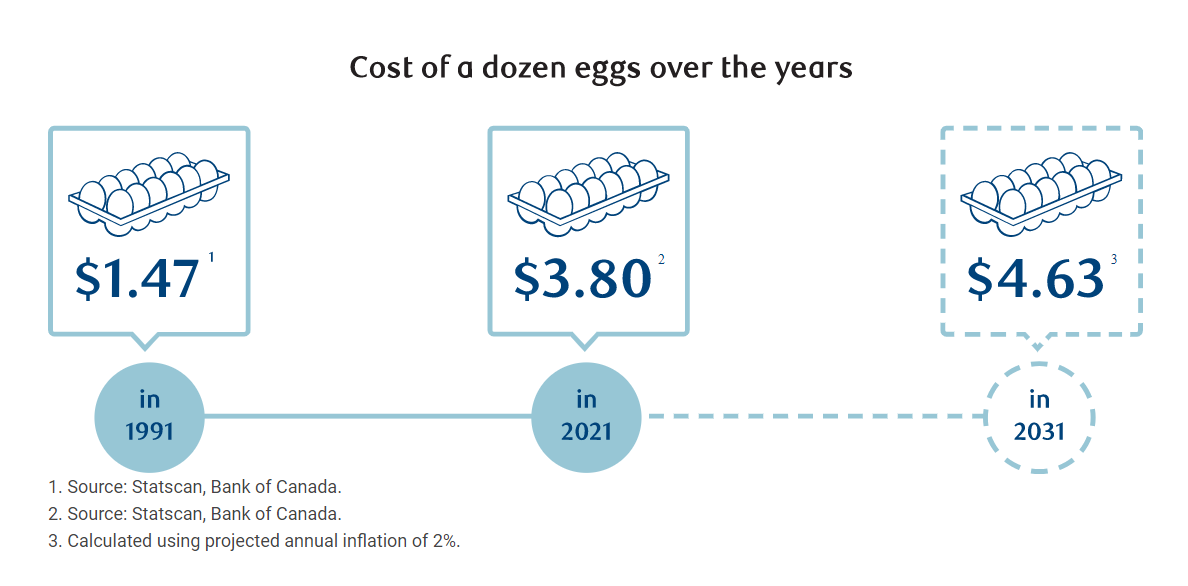

As inflation rises, your purchasing power decreases. This means that your money does not go as far or buy as many things as it did before prices rose. Inflation impacts all aspects of the economy – from consumer spending and business investments, to government policies and interest rates.

How is inflation measured?

Governments use various measures to keep tabs on the economy and implement policy decisions. One of the most commonly cited measurements by many countries is the Consumer Price Index (CPI). The CPI is usually presented as a simple number. However, a lot of work goes into compiling it.

-

In the U.S., the CPI is based on a basket of 80,000 items in more than 200 product categories across eight major groups.

-

To keep the basket up to date, 24,000 families are interviewed every two years for insights on what they actually buy. An additional 12,000 families keep diaries on their spending habits.

-

Every month, the prices of the 80,000 items are recorded. The average overall price levels are then reported as the CPI. This is used to calculate the annual and monthly rates of inflation.

The index began at a baseline level of 100 in 1982. When the CPI reached 200 in April 2006, it signified a 100 per cent increase in overall prices since the early 80’s. By June 2021, that figure was closer to 172 per cent.

Other commonly cited measurements of inflation you may hear about include:

-

Core inflation is CPI minus the more volatile price categories (i.e. food and energy).

-

Personal Consumption Expenditures Price Index (PCE) accounts for changes in consumer preferences. Sometimes, people move away from some goods and services towards others. For instance, if the price of chicken rises unexpectedly, consumers may buy pork. PCE is the U.S. Federal Reserve’s preferred measure.

What causes inflation?

-

There are two main theories: Cost-push theory states when the cost of labour and materials (and really anything that’s required to get products onto shelves) rises, this drives up the price of goods and services.

-

Demand-pull theory suggests inflation rises when consumers have money and want to spend, but there are not enough goods for purchase. In this case, it’s not the raw materials that cause the increase in prices. It’s the demand for the finished product.

From an economic perspective, cost-push forces can be a greater concern. They indicate problems in the supply of goods and services. Demand-pull forces are more positive, as they occur when the average person has more money to spend. Higher demand feeds into higher prices – a sign of a strong, expanding economy.

Why is inflation a problem?

Traditionally, a moderate level of inflation (around two per cent) is considered a positive signal. This is because it’s associated with economic growth. Higher levels of inflation are often perceived as a negative signal – suggesting the economy may be overheated. This can lead to an economic downturn, with some businesses suffering more than others. Inflationary pressures can drive higher prices. And if prices are rising faster than wages, then real incomes will drop. Inflation can also drive more government spending, as it costs more to run the same programs.

How can you protect your portfolio from the effects of higher inflation?

Inflation can affect some asset classes more than others. When inflation rises and market conditions change, it’s important to closely monitor the asset mix of your portfolio.

Equities tend to offer better protection against inflation. Company revenues, and therefore earnings, can outpace inflation over time. Over the last 20 years, equities have delivered returns approximately 6% higher than inflation.4

Diversification is key. For example, it can help to add exposure to companies with ties to commodities, real estate, or those with the ability to pass on price increases to their customers without impacting demand.

Fixed income investors are often enticed by the stable stream of income bonds provide. However, inflation and interest rates tend to move in the opposite direction from bond prices. When interest rates rise, it can reduce the value of your bond holdings.

While inflation may impact areas of the bond market in the near term, bonds play an important role in diversified portfolios by providing stability against equity market volatility. Consider bonds with a variety of characteristics including: maturity, various risk levels, as well as sovereign and corporate bonds, both domestic and global.

If you start to see the impact of inflation on your portfolio, remember: balance is everything.

-

If the portion of equities in your portfolio increases, you may experience more volatility. So keep your risk tolerance in mind when considering any changes to your portfolio.

-

Fixed income will continue to play an important role within a diversified balanced portfolio. It can help create a smoother investment experience and help you stick to your investment plan. Explore different parts of the bond market now.

Inflation is just one of the many economic forces that can affect your investments. The key is to choose investments carefully, with strategies to address inflation.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article