Published October 4, 2022 • 3 Min Read

This is why having a variety of investments in your portfolio better prepares you to ride out ups and downs.

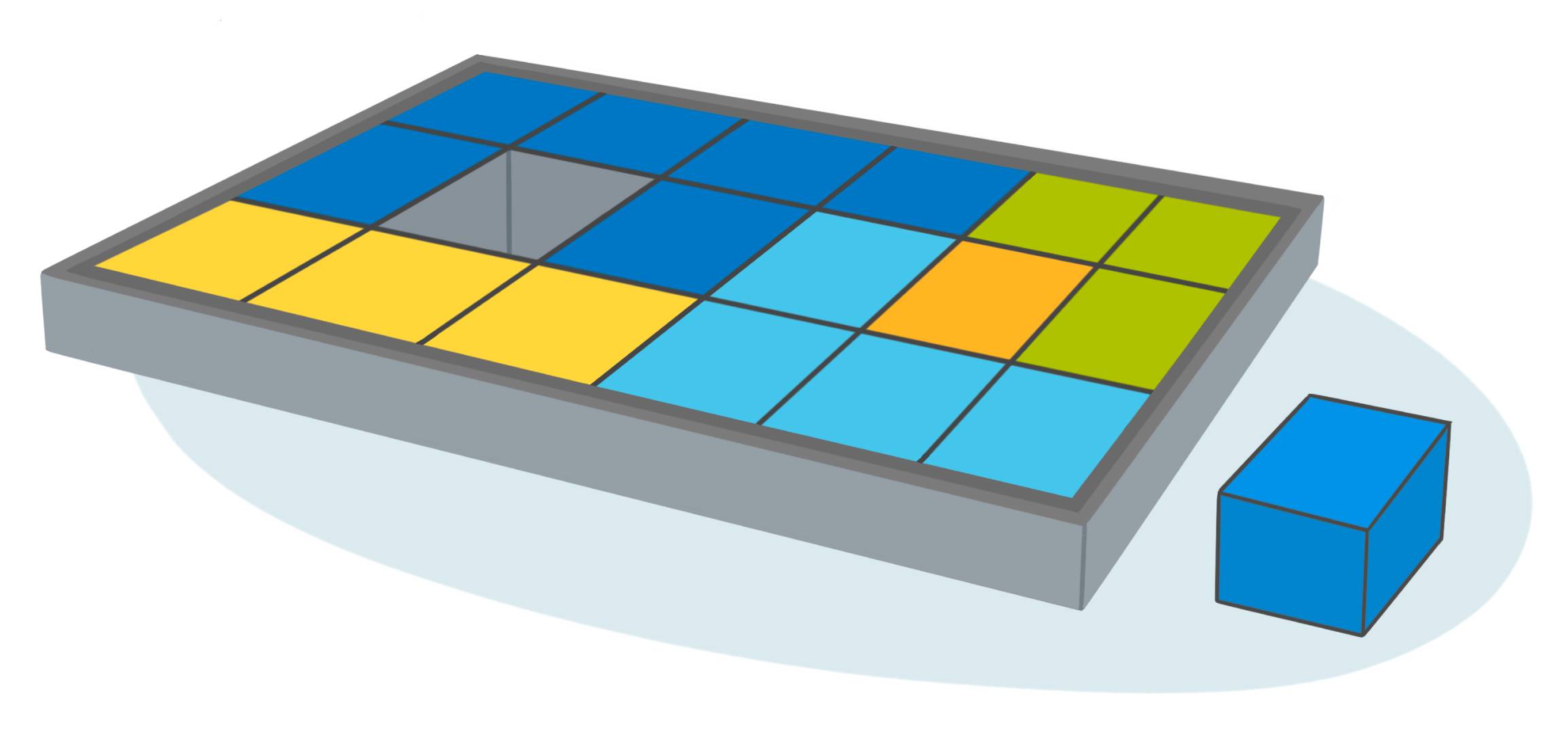

Diversification means having different kinds of investments in your portfolio. Because companies, industries and geographic regions move through different cycles of economic growth — often in unpredictable ways — it’s a smart choice to have a diversified portfolio, to help you navigate those peaks and valleys. In other words, assets that are going up in value can balance those that are going down in value. This can help to reduce overall risk in your portfolio and stabilize your returns over time.

Key takeaways

If you owned a food truck: what would happen if you only sold one product from one supplier? Your delicious snack may do well on some days, but what if your supplies are delayed or your supplier goes out of business? Maybe there is an unexpected negative scientific report about your main ingredient or it is suddenly banned. By having a variety of “snacks” (investments) in your portfolio, you are better prepared to ride out the ups and downs.

So, what kinds of investments should be part of the mix in your portfolio? The appropriate mix of the basic asset classes—cash, fixed income and equities—(your asset mix) will depend on your investment objective and other factors such as time horizon and comfort with volatility.

Cash and cash equivalent investments can provide you with a stable base for your portfolio and easy access to cash to tap into on short notice. One potential drawback is that returns may not keep up with inflation.

Fixed Income investments generate cash flow and can provide some stability to your portfolio. However, they can be sensitive to movements in interest rates. Explore and learn more in Fixed Income: The Basics.

Equity investments provide the greatest potential for long-term growth along with a higher degree of risk. Explore and learn more in Stocks: Understanding the Risk-Return Relationship.

While those three asset classes are important to take into account, there are other ways to diversify too. Consider: geography (so you have access to opportunities not available in Canada [North America] and your assets are not concentrated in any one country or region); alternative investments (such as precious metals or real estate investment trusts or REITs, which do not tend to fluctuate in the same way and time as other markets); economic sector (to balance the risk of a downturn in a particular sector); and number and concentration of your holdings (a larger, more diverse number of investments with less concentration in any one holding can reduce your risk exposure).

Diversification is an excellent strategy to help keep your portfolio balanced and to help shield you from the inevitable ups and downs of the market and economy.

Investment advice is provided by Royal Mutual Funds Inc. (RMFI). RMFI, RBC Global Asset Management Inc., Royal Bank of Canada, Royal Trust Corporation of Canada and The Royal Trust Company are separate corporate entities which are affiliated. RMFI is licensed as a financial services firm in the province of Quebec.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article