Published August 16, 2023 • 5 Min Read

Published with files from RBC Global Asset Management.

Risk is something you face all the time in your everyday life – even if it’s not always obvious. In an extreme case, you might be deciding if you’ll take friends up on their offer to go bungee jumping. Less severe, maybe you’re deciding whether to hop on your bike or into your car to head to the store.

Every conscious or subconscious action comes with some level of risk. And each time, you determine what’s right for you.

But what does risk mean when it comes to investing? From stocks to bonds, and everything in between – every investment also comes with risk. Generally, the higher the potential return, the higher the risk. To know what’s right for you, you need to determine your risk tolerance, which really means how comfortable you are with risk and with not knowing how much you will earn or lose on your investment.

To understand your own tolerance for risk, there are a few key questions you can ask yourself:

-

How comfortable would you be with market volatility?

-

How might you react to seeing your investments drop in value?

-

Are you someone who embraces investment risk because it opens the door to more opportunity, or are you more risk averse – and likely to lose sleep when the market loses ground?

How risk tolerance changes the way you invest

Risk tolerance relates to your willingness to take on risk to achieve your goals. It’s based on your beliefs, your personality and your investment experience. Think of it as your mental and emotional ability to handle possible investment losses.

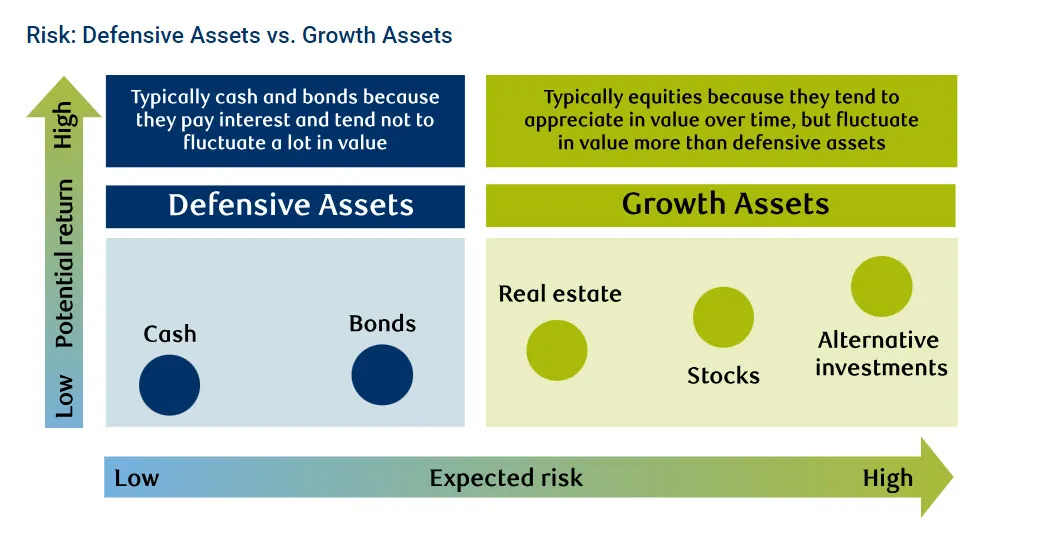

For example, if you are more comfortable with risk, you may choose investments that offer faster growth and higher potential returns – even if it means your holdings may lose value at times. If you’re a risk-averse investor, the opposite is true. You might opt for investments that aim to ‘defend’ your investments against losses – even if it means the possibility of lower returns.

Source: RBC Global Asset Management

How risk capacity changes the way you invest

Risk capacity is not based on your feelings about risk. It’s not even based on any specific investment. Instead, it relates to how much risk you can afford to take. And that has to do with your financial situation, as well as your age and the time you have to invest.

| Risk Tolerance | Risk Capacity |

|---|---|

| Your willingness to take risk | Your ability to absorb the impact of investment losses as you pursue higher potential returns |

| Reflects your personality, your beliefs and your investment experience | Varies with your age, income and net worth |

Here are some examples of questions you can ask yourself to determine how potential losses would affect your ability to reach your financial goals:

-

Are you saving for your child’s education? How many years before they finish high school? Will you have time to make up any losses if you take more risk as an investor?

-

Are you close to retiring? How much have you saved? How will it affect your plans if your retirement fund drops 5 or 10 per cent in value before you retire?

-

Is time on your side? Do you have many years to invest? Or will you need to take money out of your investment account soon

The importance of time

Time is an important consideration for risk capacity for a number of reasons, such as:

-

The longer you have to invest, the more time you have to make up for any losses along the way. Over time, markets generally recover from losses. So, if you have a long-term goal, such as saving for retirement, you may have a larger capacity to take on risk in your portfolio.

-

But, you may not be able to tolerate that level of day-to-day movement even if your financial situation and time horizon say you can. You might still opt for a lower-risk option that matches your tolerance.

-

The opposite is true if you have a shorter time to invest. Let’s say you have a nearer-term goal of buying a home in the next year. You now have less time to make up for any losses, so you can’t afford to see any significant drops in your investments. In this case, you may want to opt for more conservative, low-risk investments – even if you think you could handle the emotions that come with losses.

Finding balance

Ideally the investments you choose are in line with your risk tolerance and your risk capacity. If not, you may take on more risk than you can afford – or sit in safety to such a degree that your savings grow too slowly. Either way, you may find it more challenging to reach your financial goals. That’s why it’s important to understand your own approach to risk and how it affects you.

To learn more about what level of risk is right for you, check out the helpful questionnaires about risk tolerance and risk capacity from RBC Global Asset Management.

Investment advice is provided by Royal Mutual Funds Inc. (RMFI). RMFI, RBC Global Asset Management Inc., Royal Bank of Canada, Royal Trust Corporation of Canada and The Royal Trust Company are separate corporate entities which are affiliated. RMFI is licensed as a financial services firm in the province of Quebec.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article