Published March 1, 2023 • 4 Min Read

Developed market central banks have been active recently, so much so that it can be hard to keep up. Here’s a quick summary of some of the major central bank policy decisions:

-

The Bank of Canada raised rates by 25 bps to 4.5% and signaled they’re likely on pause for the time being.

-

The Fed raised rates by 25 bps to a target range of 4.5-4.75%. Policymakers feel they are nearing the end of this hiking cycle but expect to make at least a couple more hikes to get there.

-

The Bank of England (BoE) and the European Central Bank (ECB) both raised rates by 50bps but the subsequent messaging was different. The BoE signaled that they’re almost done their tightening, while President Lagarde of the ECB said they “have ground to cover” and that they are not done yet.

While in the Canadian case, rate hikes appear to be over, it’s clear that other central banks still have more work to do. However, most of the central banks that do continue to raise rates may be able to do so at a slower pace and eventually pause rate hikes later this year. This has important implications for fixed income markets, given that hawkish central banks were a key driver of volatility in 2022.

Bonds tend to rally ahead of peak interest rates

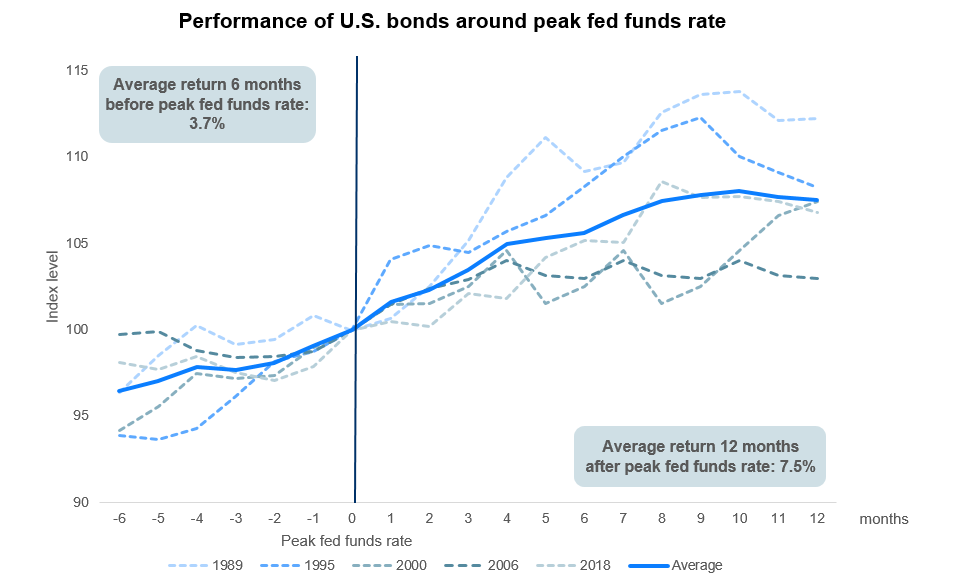

With this in mind, we thought we’d look at how fixed income markets perform prior to and following the peak in the fed funds rate in previous hiking cycles. The chart below highlights performance of U.S. investment grade bonds during the last five instances of peak fed funds rates. These instances are shown by the dotted lines, while the dark solid line represents the average return.

Source: Bloomberg, RBC GAM. Performance 6 months before and 12 months after peak fed funds rate for FTSE US GBI Index, December 2022.

Here are some key data points and takeaways:

-

You don’t have to see peak fed funds rate for bonds to start rallying. On average, in the 6 months leading up to peak fed funds rate, bonds returned 3.7%.

-

The period following peak fed funds rate tends to be a strong environment for bonds. In the 12 months following peak fed funds rate, bonds returned an average of 7.5%.

-

Fixed income markets are notoriously forward looking and can start to see past what central banks are doing right now and price in what’s to come in the months ahead. In the U.S., the market currently has the peak Fed funds rate priced in by June of 2023, about 5 months out.

-

We’ve already started to see fixed income markets rebound as inflation fears subsided and investors weigh the possibility of a recession.

Central bankers have done a good job of getting interest rates to levels needed to temper inflation and our models now suggest the distance between where interest rates are and where they should be has narrowed significantly. At the same time, the path forward for inflation is hardly certain, and some central banks have rate hikes left to do. However, as history has shown us, that doesn’t mean that bond returns must remain negative until the heavy lifting is done.

Bonds now offer their most compelling return potential since the onset of the global financial crisis, especially as inflation cools and economic activity slows. Over the next year, the full effect of last year’s rate hikes is going to be felt and bond returns could be bolstered by the significant probability that most developed-market economies slide into recessions. Considering the extent of their sell-off government and higher quality bonds should benefit from that tailwind.

Investment advice is provided by Royal Mutual Funds Inc. (RMFI). RMFI, RBC Global Asset Management Inc., Royal Bank of Canada, Royal Trust Corporation of Canada and The Royal Trust Company are separate corporate entities which are affiliated. RMFI is licensed as a financial services firm in the province of Quebec.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article