Published June 26, 2018 • 7 Min Read

They expect to pay for anything (products, services, apps, music and more) from anywhere, at any time of the day — and they want the whole experience to be fast, convenient and

secure.

Over the past decade, technical, social and economic developments have been challenging the payments system around the globe and at home. And while the Canadian payments infrastructure is recognized as one of the most secure around, we’re committed to making our systems even better when it comes to convenience and data, allowing Canada and Canadian businesses to innovate further and become even more efficient. As in many other countries globally, the Canadian payment ecosystem, with its multiple stakeholders, is embarking on a modernization journey to implement next-generation payment systems that are fast, flexible, and secure, and that foster innovation and competition across the Canadian marketplace.

What This Could Mean for Your Business

By introducing next-generation payment systems that are data-rich, flexible, and adaptable, Canada will enable a platform for innovation, and provide the rich, efficient systems Canada needs to compete in the future.

1. Richer data. Modernized payment systems carry rich, standardized data alongside payments, rather than transmitting it separately as happens today. This gives context to the payments and allows businesses to begin to automate key business processes such as accounts payable and accounts receivable. Currently, many B2B payments are made by mailing cheques — just so that the invoice information can travel with the payment. With a modernized payments system, invoice details can travel electronically with the funds, making for more robust reporting, easier reconciliation and a more secure transaction from start to finish.

2. Faster and more efficient payments. Modernized payments are faster payments. With data travelling with the payment, you will have funds in your hands faster, and have certainty about the invoice or client the payment is associated with. The benefit? It can allow you to release further goods or services to a client who may have reached their credit limit with you. It can also enable your service or sales staff to immediately request payment and be paid, spending less time on administrative activities and more on truly serving customers and helping them with their needs.

3. Enhanced convenience. In addition to making a payment or transfer through email or a mobile number, imagine making “hands-off” payments – your accounts payable will easily integrate into the bank’s payment system and complete your payments – with data. More convenient payments could even help you improve your supply chain or business model. What’s more, senders and recipients will get notifications and confirmations as to the status of their payments, which has the added bonus of cutting down on paper and mailing costs.

4. Seamless needs matching. The new systems will allow businesses like yours to match your payment need to the system used to process it. For example, a higher value transaction will use the payments system specifically designed to process and protect transactions that need an extra layer of security. At the same time, a lower-value transaction could be conducted using the real-time system, for faster processing. A better alignment between payment type and payment system will reduce costs for business and create the opportunity for more efficient cross-border transactions.

5. Better security, risk management and privacy. Business funds and data will be more secure, as new and enhanced systems will be in a better position to adapt to emerging threats, including enhanced fraud protection. Next-generation privacy and risk management tools will also be built into the systems giving businesses of all sizes seamless access to protection for their finances and information.

What You Need to Do to Prepare for These Changes

Fortunately, many financial institutions, including RBC, are currently developing solutions that will allow businesses to take advantage of the opportunities and benefits that will arise from the upcoming changes. And while solutions will be available to support you, there are a few things you can do to prepare.

1. Determine how you want to manage 24/7/365 customer payments. For instance, will you invest to automate this process, or manage this by updating your terms?

2. Think about your current infrastructure and how best to take advantage of the incoming information — and how it might improve your cash application process. In many cases, a short term and long term strategy will make sense.

3. Review and understand the opportunity to increase automation of historically labour-intensive activities. For instance, can inventory management become a more streamlined activity? What about purchase orders?

Across the board, businesses are going to be able to reduce their reliance on paper, accelerate their cash flow, integrate information across their entire financial supply chain and reduce friction points in the purchasing process.

Stephen Miller, RBC

How Changes Will Be Implemented

Around the world, countries are actively updating their payments infrastructure. With 17 countries having modernized to date, Canada has had the opportunity to study these global efforts and understand what works best when updating and improving the national payments system.

Modernizing Canada’s payments system is a complex, multi-year endeavour that will affect consumers, businesses, the government and financial institutions… and provide a platform for innovative solutions and increased efficiencies for the economy.

Diane Amato is a Toronto-based freelance writer who loves to talk about finances, travel and technology.

Shannon Lattin is a creative based in the United Kingdom, where she designs and illustrates for digital media.

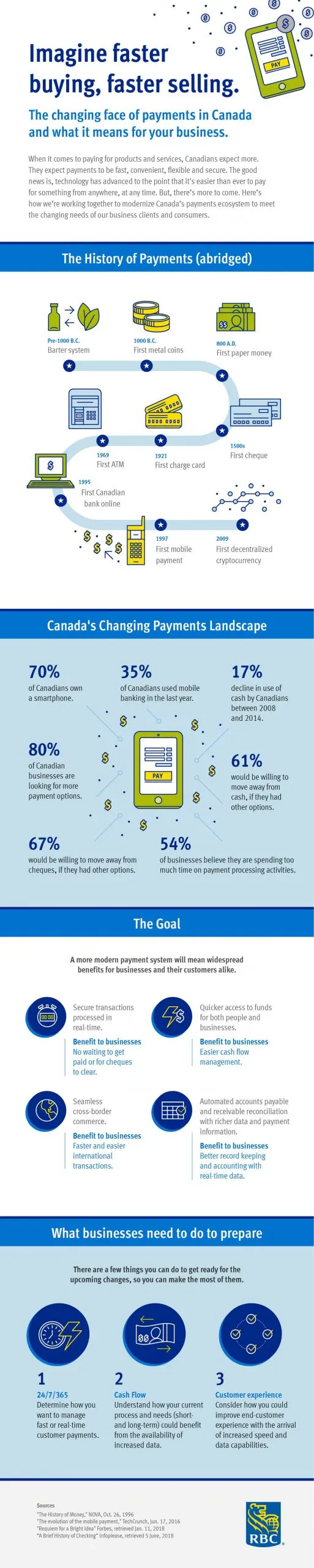

Imagine faster buying, faster selling.

The changing face of payments in Canada and what it means for your business.

When it comes to paying for products and services, Canadians expect more. They expect payments to be fast, convenient, flexible and secure. The good news is, technology has advanced to the point that it’s easier than ever to pay for something from anywhere, at any time. But, there’s more to come. Here’s how we’re working together to modernize Canada’s payments ecosystem to meet the changing needs of our business clients and consumers.

The History of Payments (abridged)

Pre-1000 B.C.

Barter system

1000 B.C.

First metal coins

800 A.D.

First paper money

1500s

First cheque

1921

First charge card

1969

First ATM

1995

First Canadian bank online

1997

First mobile payment

2009

First decentralized cryptocurrency

Canada’s Changing Payments Landscape

70%

of Canadians own a smartphone.

35%

of Canadians used mobile banking in the last year.

17%

decline in use of cash by Canadians between 2008 and 2014.

80%

of Canadian businesses are looking for more payment options.

61%

would be willing to move away from cash, if they had other options.

67%

would be willing to move away from cheques, if they had other options.

54%

of businesses believe they are spending too much time on payment processing activities.

The Goal

A more modern payment system will mean widespread benefits for businesses and their customers alike.

Secure transactions processed in real-time.

Benefit to businesses

No waiting to get paid or for cheques to clear.

Quicker access to funds for both people and businesses.

Benefit to businesses

Easier cash flow management.

Seamless cross-border commerce.

Benefit to businesses

Faster and easier international transactions.

Automated accounts payable and receivable reconciliation with richer data and payment information.

Benefit to businesses

Better record keeping and accounting with real-time data.

What businesses need to do to prepare

There are a few things you can do to get ready for the upcoming changes, so you can make the most of them.

1

24/7/365

Determine how you want to manage fast or real-time customer payments.

2

Cash Flow

Understand how your current process and needs (short- and long-term) could benefit from the availability of increased data.

3

Customer experience

Consider how you could improve end-customer experience with the arrival of increased speed and data capabilities.

Sources

“The History of Money,” NOVA, Oct. 26, 1996

“The evolution of the mobile payment,” TechCrunch, Jun. 17, 2016

“Requiem for a Bright Idea” Forbes, retrieved Jan. 11, 2018

“A Brief History of Checking” Info please, retrieved 5 June, 2018

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article