Published May 4, 2023 • 5 Min Read

Do you have a go-to catch phrase for spring? Maybe it’s “April showers bring May flowers” or “spring fever.” For investors, a popular adage that springs up at this time of year is “sell in May and go away.” But what does it mean? And is it beneficial for investors? Let’s dig in.

First, it doesn’t mean that you should sell off your worldly possessions in May and take off on vacation – as fun as that sounds! In fact, it’s a market-timing strategy that investors have debated for decades, and refers to selling off investments in the spring and then getting back into the markets around Halloween when stock markets are presumed to start performing better. Fun fact: that’s why “sell in May” is also known as the “Halloween Indicator.”

Horse races and Halloween: A quick history lesson

The original is “Sell in May and go away; Don’t come back ’til St. Leger Day” and the sing-song expression originated in Britain when the financial district structured business around sporting and social events. St. Leger Day is the final horse race in the British Triple Crown and takes place in September to mark the end of the summer social season. The first meaning behind the adage was to sell stocks before the summer holidays, when businesses would traditionally slow down.

Theories abound about whether it’s best to “sell in May” or “stay and play.” The first has investors jump out of markets for the summer while the second has investors stay invested without interruption. Original observations were that markets typically perform better between November and April than they do between May and October.

Does ‘sell in May’ really work?

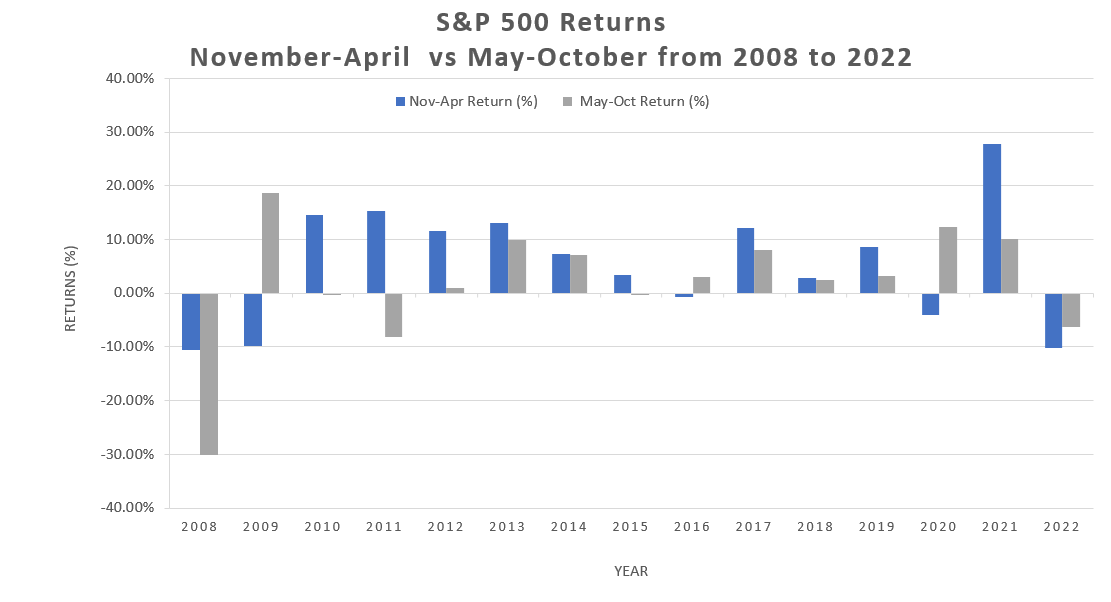

To determine if this investing strategy has delivered outsized returns to investors in recent years, let’s look at returns for the S&P 500 Index from 2008 to 2022 and segment returns from November to April and returns from May to October (i.e., “sell in May”).

Source: Factset. Note that the November to April time period runs from November 1 of the previous year to April 30 of the year for which the data is presented. Chart created April, 2023.

The average rate of return from November to April is 5.40 per cent and from May to October is 2.04 per cent. At first glance, this would support the “sell in May” theory.

However, there’s more to this story. To better understand the implications of such an approach, we need to also compare the returns of a “sell in May” strategy against a “stay and play” strategy.

What if investors ‘stay and play’ in the market?

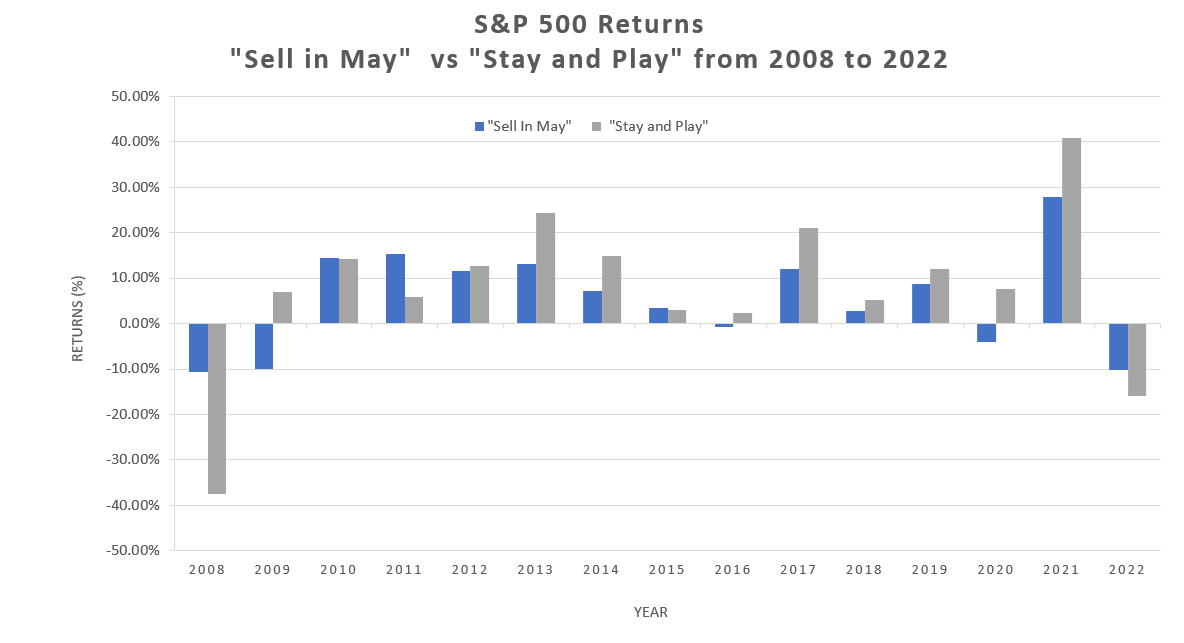

For “sell in May,” let’s assume that you sell at the end of April and sit in cash between October and May. For simplicity, we assume that you would not earn interest on this cash. For “stay and play,” you would stay invested in the S&P 500 for the entire period (November 1 of the previous year to October 31 of the current year).

In the chart below, we see that “stay and play” compares favorably to “sell in May.” The “sell in May” approach returned an average annual return of 5.4 per cent per year, while “stay and play” returned an average of 7.86 per cent over this 15-year time period. In other words, “stay and play” outperformed “sell in May” by an average of 2.46 per cent.

Source: Factset. Note that the November to April time period runs from November 1 of the previous year to April 30 of the year for which the data is presented. Chart created April, 2023.

Should investors ‘sell in May and go away’?

While the S&P 500 has typically appeared to do better in the winter-to-spring period, performance varies dramatically over the years. Over the 15-year period we examined, investors would have benefitted by staying invested. Additionally, our analysis does not incorporate dividends that you might earn on some investments, which are often a key contributor to overall returns over the long term.

Timing the market can be a risky approach. Just because markets have exhibited certain trends in the past, we shouldn’t expect they will perform the same way in the future.

Attempting to “time the market” by deciding when to buy and sell your investments is not only risky but can also lead you to stay on the sidelines rather than investing your money. There’s no such thing as a crystal ball and we simply can’t time our investments perfectly. Plus, history shows that investing on a regular basis is a winning strategy.

Overall, rather than trying to time the market with a strategy such as sell in May,” contributing to your investments on a regular basis with tools like pre-authorized contribution plans can mean more time to actually stop and smell the…tulips.

Investment advice is provided by Royal Mutual Funds Inc. (RMFI). RMFI, RBC Global Asset Management Inc., Royal Bank of Canada, Royal Trust Corporation of Canada and The Royal Trust Company are separate corporate entities which are affiliated. RMFI is licensed as a financial services firm in the province of Quebec.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article