Published August 21, 2023 • 4 Min Read

This article was published with files from RBC Global Asset Management.

As investors, it’s pretty common to wish for a crystal ball that can show us where markets are headed. But what about a time machine? And, specifically, one that could take you back to the perfect time to invest?

OK, full disclosure… we don’t have one. But we recently heard about a way to put market uncertainty into perspective, which can help us keep our emotions in check when it comes to making investing decisions. This thought exercise comes courtesy of RBC Global Asset Management (RBC GAM), and we think it’s a great one to share. Jump into our, ahem, Delorean, and we’ll explain.

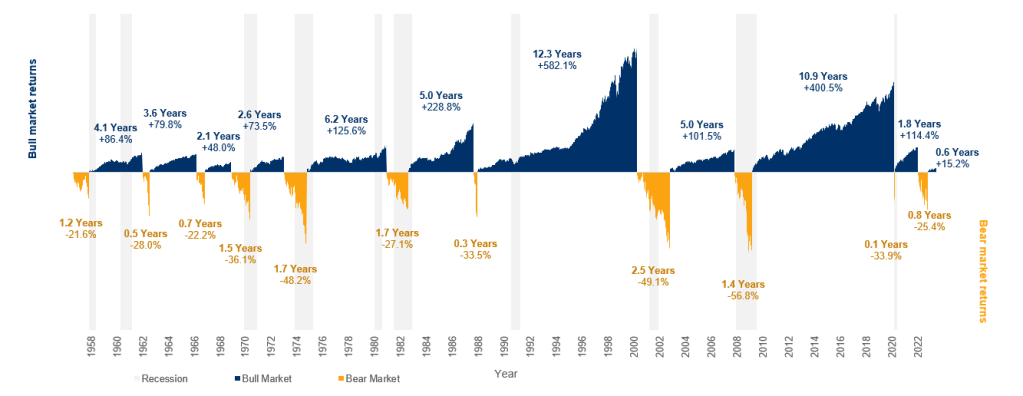

The question posed was this: If you had a time machine and cash to invest, what time period would you return to in the markets? Before you decide, check out this history of U.S. bull and bear markets.

A history of U.S. equity bull and bear markets

As of June 13, 2023. Reflects S&P 500 Index in USD. Source: RBC GAM, Bloomberg. An investment cannot be made directly into an index. The graph does not reflect transaction costs, investment management fees or taxes. If such costs and fees were reflected, returns would be lower. Past performance is not a guarantee of future results. Bull market starts from lowest close reached after market has fallen 20% of more. Bear market starts from when the index closes at least 20% down from its previous high.

If you were to choose a spot to jump into markets, many investors would look at that chart and land on the logic of buying low – when securities are “on sale” – and riding through the expansion. Most wouldn’t choose to get in at the top of the market, of course!

As the chart shows, U.S. equity markets saw 10 distinct bear market events over the past 70 years. According to RBC GAM, this suggests that, on average, long-term investors should expect to encounter a bear market roughly once every seven years.

When markets are choppy and investors feel uncertain about what to do (or not do), it can be helpful to remember the cyclical nature of markets that becomes clear in that historical view.

Watching the value of your investments fluctuate can be an emotional experience. According to RBC GAM , bear markets are a normal part of the long-term investment cycle – even if it may not feel like it in the moment. During these times, making dramatic changes to your investment portfolio may feel like a natural reaction. However, this can have a impact on your ability to reach your long-term goals.

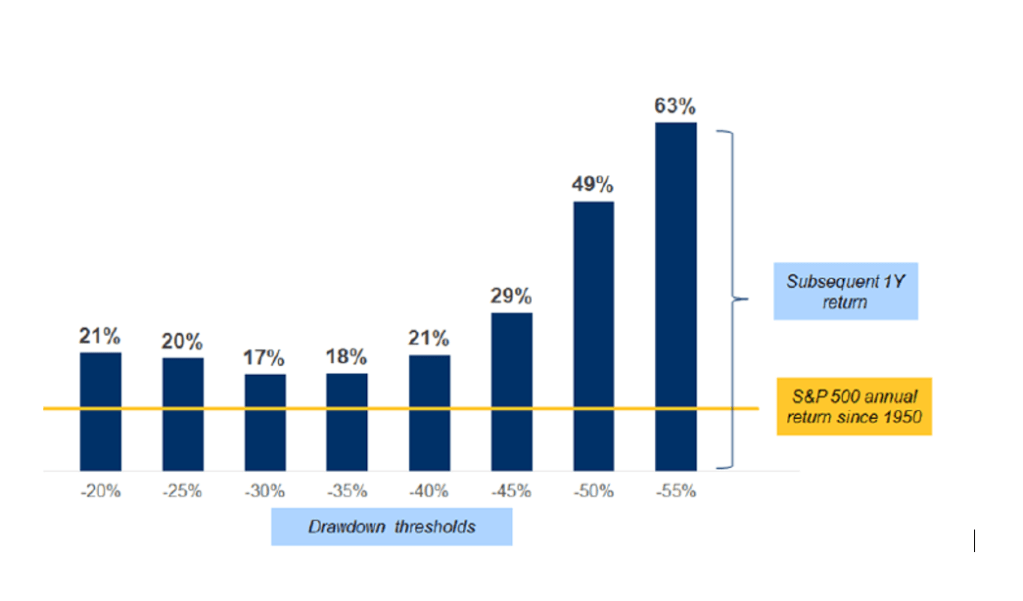

On top of the cyclical tendency, the chart below shows that each time the market has dropped by a significant amount, the bounce back in the following year has also been significant. This pattern has repeated across bear markets since 1950.

Return Following Volatility – S&P 500

Source: RBC GAM, Bloomberg. S&P 500 TR (USD). Data reflects time period of January 1, 1950 to February 29, 2020. Subsequent 1-year return reflects the median 1-year return. An investment cannot be made directly into an index. The graph does not reflect transaction costs, investment management fees or taxes. If such costs and fees were reflected, returns would be lower. Past performance is not a guarantee of future results.

Unfortunately, we don’t have an actual time machine and the future remains unknown. However, history has some powerful lessons that can help guide logical investing decisions over emotional ones. But still, a time machine would be fun, wouldn’t it?

Financial planning services and investment advice are provided by Royal Mutual Funds Inc. (RMFI). RMFI, RBC Global Asset Management Inc., Royal Bank of Canada, Royal Trust Corporation of Canada and The Royal Trust Company are separate corporate entities which are affiliated. RMFI is licensed as a financial services firm in the province of Quebec.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article